The Mortgage Bankers Association released its year-end ranking of commercial and multifamily mortgage servicers’ volumes, with Wells Fargo Bank N.A. at the top with $712 billion in master and primary servicing.

Category: News and Trends

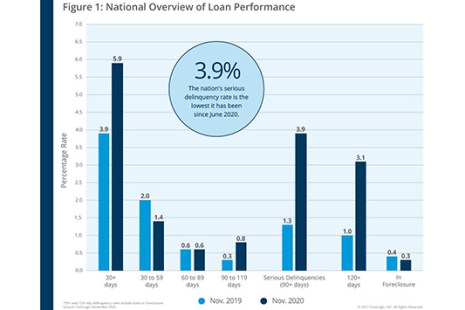

CoreLogic: November Mortgage Delinquency Rates at 11-Month Low

CoreLogic, Irvine, Calif., said new November mortgage delinquencies fell below pre-pandemic levels and, while serious delinquencies fell to their lowest levels since June.

MBA: 2021 Commercial/Multifamily Mortgage Maturity Volumes to Increase 36%

The Mortgage Bankers Association said $222.5 billion of the $2.3 trillion (10 percent) in outstanding commercial and multifamily mortgages held by non-bank lenders and investors will mature in 2021, a 36 percent increase from the $163.2 billion that matured in 2020.

Quote

“For the second consecutive quarter, homeowners’ ability to make their mortgage payments improved…mortgage forbearance, foreclosure moratoriums, enhanced unemployment benefits and stimulus payments have helped distressed homeowners remain in their homes.”

–Marina Walsh, CMB, MBA Vice President of Industry Analysis.

Nick Volpe: Managing Effects of Changing Regulations on Mortgage Servicing Operations

As loan servicers continue to battle operational challenges and brace themselves for continuously high volume, there are strategies they should consider to better navigate the changing landscape.

MBA, Coalition Urge Homeowner Relief in COVID-19 Package

The Mortgage Bankers Association and nearly 300 other industry trade groups and community organizations urged Congress to include direct assistance to homeowners with COVID-19 hardships in any upcoming economic stimulus package.

Nick Volpe: Managing Effects of Changing Regulations on Mortgage Servicing Operations

As loan servicers continue to battle operational challenges and brace themselves for continuously high volume, there are strategies they should consider to better navigate the changing landscape.

MBA CREF 2021: A Conversation with GSE Leadership

One year ago, nearly no one could have predicted what 2020 would bring. Everyone in the real estate world had to adjust their expectations.

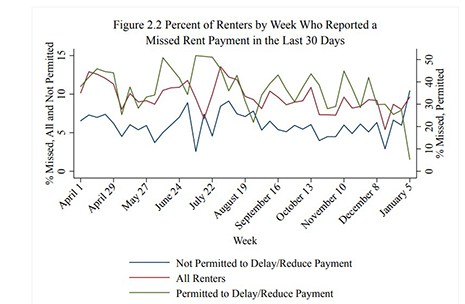

MBA RIHA Study Shows Progress, but 5 Million Renters, Homeowners Missed December Payments

Five million households did not make their rent or mortgage payments in December, and 2.3 million renters and 1.2 million mortgagors believe they are at risk of eviction or foreclosure or would be forced to move in the next 30 days, according to fourth-quarter research by the Mortgage Bankers Association’s Research Institute for Housing America.

Troubled Commercial Mortgage Loan Triage: A Special Servicer Roundtable

With the ebb and flow of 2020 market disruption in the rearview mirror and the vaccine rollout in full swing, MBA NewsLink checked in with two special servicers, a rating agency servicer analyst and Freddie Mac asset management chief to explore what is happening in commercial/multifamily markets, where different parts of the commercial real estate finance ecosystem are today and factors driving the outlook for agency and non-agency CMBS sectors.