The Mortgage Bankers Association, in a letter last week to the Federal Reserve, offered recommendations on how the Fed could improve the Community Reinvestment Act to improve credit access and more effectively meet the needs of low- and moderate-income communities.

Category: News and Trends

FHFA Releases 2021 Scorecard for GSEs, Common Securitization Solutions

The Federal Housing Finance Agency last week released the 2021 Scorecard for Fannie Mae, Freddie Mac and Common Securitization Solutions. The 2021 Scorecard aligns the 2019 Strategic Plan with the Enterprises’ tactical priorities and operations, serving as an essential tool to hold the Enterprises accountable.

Biden Administration Extends, Expands Forbearance/Foreclosure Relief Programs

The Biden Administration yesterday announced a coordinated extension and expansion of forbearance and foreclosure relief programs. The programs, set to expire at the end of March, have now been extended through June 30.

Quote

“The share of loans in forbearance has declined for three weeks in a row, with portfolio and PLS loans decreasing the most this week. This decline was due to a sharp increase in borrower exits, particularly for IMB servicers. Requests for new forbearances dropped to 6 basis points, matching a survey low.”

–Mike Fratantoni, MBA Senior Vice President and Chief Economist.

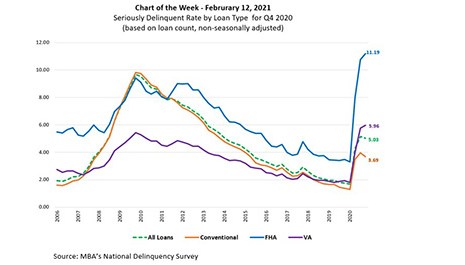

MBA Chart of the Week: NDS Seriously Delinquent Rate By Loan Type

MBA last week released its National Delinquency Survey results for the fourth quarter. The delinquency rate for mortgage loans on one-to-four-unit residential properties at the end of the quarter decreased from a seasonally adjusted rate of 7.65 percent of all loans outstanding in the third quarter to 6.73 percent in the fourth quarter. This 92-basis-point drop in the delinquency rate was the biggest quarterly decline in the history of MBA’s survey dating back to 1979.

Anita Bush: Effective Forbearance Management for Mortgage Loan Servicers

In this article, we’ll address some of the servicer’s legal requirements and offer three keys to success intended to help servicers manage the post-forbearance process.

MBA: 4th Quarter Delinquencies See Decline from 3Q, Up from Year Ago; Foreclosure Inventory at Near 40-Year Low

The Mortgage Bankers Association’s 4th Quarter National Delinquency Survey reported the delinquency rate for mortgage loans fell by 92 basis points from the third quarter to 6.73 percent, seasonally adjusted. From a year ago, however, mortgage delinquencies increased across the board.

CMBS Delinquency Rate Declines for Third Straight Month

Fitch Ratings, New York, reported the U.S. commercial mortgage-backed securities delinquency rate fell 14 basis points in January to 4.55 percent due to a slowing pace of new delinquencies and strong new issuance.

ATTOM Reports Record-Low Foreclosures

ATTOM Data Solutions, Irvine, Calif., said 9,701 U.S. properties reported foreclosure filings in January, down by 11 percent from a month ago and down by 80 percent from a year ago.

MBA Letter Outlines Fiscal 2021 Budget Priorities

The Mortgage Bankers Association, in a Feb. 10 letter to the House Financial Services Committee, outlined several priorities it supports as the committee wrestles with its markup of the federal government’s fiscal 2021 budget.