The Federal Housing Finance Agency announced Thursday that Fannie Mae and Freddie Mac will continue to offer COVID-19 forbearance to qualifying multifamily property owners through June 30, subject to the continued tenant protections FHFA imposed during the pandemic. The programs were set to expire March 31.

Category: News and Trends

CFPB Proposes Delay of QM Final Rule Mandatory Compliance Date to Oct. 2022

The Consumer Financial Protection Bureau on Wednesday issued a notice of proposed rulemaking to delay the mandatory compliance date of the General Qualified Mortgage final rule by more than a year, from July 1 to Oct. 1, 2022.

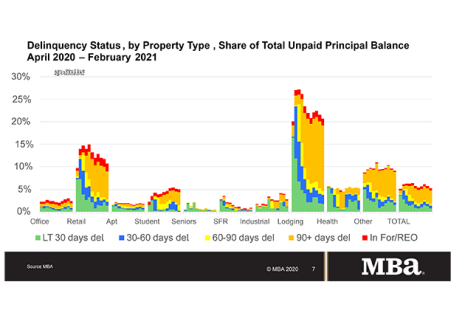

MBA: February Commercial, Multifamily Mortgage Delinquency Rates Decrease

Delinquency rates for mortgages backed by commercial and multifamily properties decreased in February, as the COVID-19 pandemic’s impact on commercial and multifamily mortgage performance continues to vary by the different types of commercial real estate, the Mortgage Bankers Association reported Thursday.

Joe Murin of JJAM Financial Services on the Future of the Housing Market—and the GSEs

Joe Murin is Chairman of JJAM Financial Services, Pittsburgh, Pa., which he founded in 2014. He previously served as Chairman of Chrysalis Holdings LLC and as CEO of ANC Holdings LP. Before that, he was Vice Chairman of The Collingwood Group and served as President of Ginnie Mae during the Obama Administration.

CMBS Delinquency Rate Drops 8th Straight Month

In February, the commercial mortgage-backed securities delinquency rate saw its largest improvement since the pandemic started last year, reported Trepp, New York.

CFPB Study: 11 Million Families at Risk of Losing Housing

With federal foreclosure moratoria slated to end June 30, the Consumer Financial Protection Bureau this week issued a report warning of widespread evictions and foreclosures, absent additional public and private action.

Quote

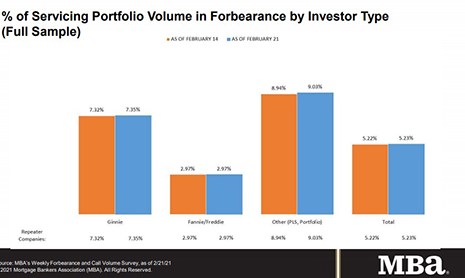

“The improving economy, the soon-to-be passed stimulus package and the many homeowners in forbearance reaching the 12-month mark of their plan could all influence the overall forbearance share in the coming months.”

–MBA Chief Economist Mike Fratantoni.

MBA: Share of Mortgage Loans in Forbearance Inches Up

For the first time in five weeks, loans in forbearance increased, albeit ever so slightly, the Mortgage Bankers Association reported yesterday.

Daren Blomquist of Auction.com on the Current State of the Distressed Marketplace

Daren Blomquist is vice president of market economics with Auction.com., Irvine, Calif. He analyzes and forecasts complex macro and microeconomic data trends within the marketplace and greater industry to provide value to both buyers and sellers using the Auction.com platform.

MBA Letter to FHFA Offers Recommendations on Appraisal Policies

The Mortgage Bankers Association, in a Feb. 26 letter to the Federal Housing Finance Agency, offered a set of recommendations aimed at promoting and modernizing the appraisal process.