The Consumer Financial Protection Bureau on Mar. 9 issued an interpretive rule clarifying that prohibition against sex discrimination under the Equal Credit Opportunity Act and Regulation B includes sexual orientation discrimination and gender identity discrimination.

Category: News and Trends

Despite Home-Equity Uptick, Black American Median Home Values Lag Behind

Despite promising data showing substantial gains in home equity, Black Americans still lag well behind other demographic cohorts, according to a new report from Redfin, Seattle.

MBA Letters Address GSE Liquidity Requirements, ‘Living Wills’

The first letter offers recommendations on how FHFA can improve its framework for codifying new liquidity requirements for Fannie Mae and Freddie Mac. The second letter addresses an FHFA proposal to require Fannie and Freddie to develop and maintain “living wills” in the event one or both of them becomes insolvent.

Quote

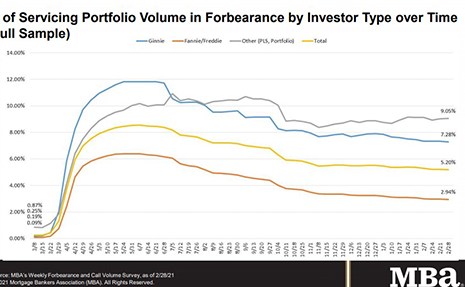

“The improving economy, the soon-to-be passed stimulus package and the many homeowners in forbearance reaching the 12-month mark of their plan could all influence the overall forbearance share in the coming months.”

–MBA Chief Economist Mike Fratantoni.

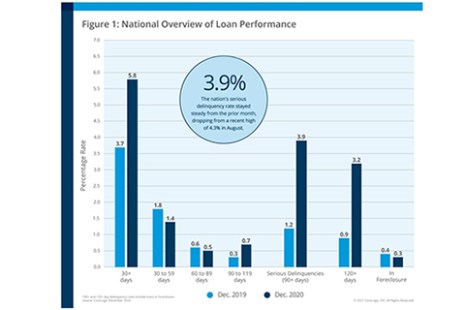

2020 Mortgage Delinquencies See Record Highs—and Record Lows

CoreLogic, Irvine, Calif., said its year-end Loan Performance Insights Report showed overall mortgage delinquency rates fell for the fourth straight month in December, ending a volatile year with signs of recovery.

MBA: Share of Mortgage Loans in Forbearance Decreases to 5.20%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 3 basis points to 5.20% of servicers’ portfolio volume as of February 28 from 5.23% the previous week. MBA estimates 2.6 million homeowners are in forbearance plans.

FHFA Extends COVID-19 Multifamily Forbearance through June 30

The Federal Housing Finance Agency announced Thursday that Fannie Mae and Freddie Mac will continue to offer COVID-19 forbearance to qualifying multifamily property owners through June 30, subject to the continued tenant protections FHFA imposed during the pandemic. The programs were set to expire March 31.

CFPB Proposes Delay of QM Final Rule Mandatory Compliance Date to Oct. 2022

The Consumer Financial Protection Bureau on Wednesday issued a notice of proposed rulemaking to delay the mandatory compliance date of the General Qualified Mortgage final rule by more than a year, from July 1 to Oct. 1, 2022.

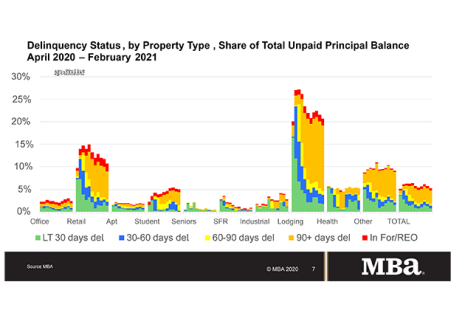

MBA: February Commercial, Multifamily Mortgage Delinquency Rates Decrease

Delinquency rates for mortgages backed by commercial and multifamily properties decreased in February, as the COVID-19 pandemic’s impact on commercial and multifamily mortgage performance continues to vary by the different types of commercial real estate, the Mortgage Bankers Association reported Thursday.

Joe Murin of JJAM Financial Services on the Future of the Housing Market—and the GSEs

Joe Murin is Chairman of JJAM Financial Services, Pittsburgh, Pa., which he founded in 2014. He previously served as Chairman of Chrysalis Holdings LLC and as CEO of ANC Holdings LP. Before that, he was Vice Chairman of The Collingwood Group and served as President of Ginnie Mae during the Obama Administration.