While there is a tremendous benefit to adding Ginnie Mae specified (spec) pools as part of a diversified execution strategy, lenders cannot continue to operate as if it’s business as usual when faced with the current volatility in the mortgage-backed securities market. Instead, speed must become of the essence, and lenders need to move as quickly as possible while monitoring the MBS market closely to continue effectively utilizing this strategy and maximize their secondary profitability.

Category: News and Trends

MBA Letters Oppose Proposed N.Y. Mezzanine Debt/Preferred Equity Tax, Support Like-Kind Exchanges

The Mortgage Bankers Association weighed in to oppose a proposed New York tax and recording requirement for mezzanine debt and preferred equity and to support like-kind exchanges.

A Conversation with MBA Affordable Housing Advisory Council Co-Chairs

The Mortgage Bankers Association recently created two Affordable Advisory Councils, dedicated to supporting CONVERGENCE, the MBA Affordable Housing Initiative. These Councils are currently led by four senior executives: Christine Chandler (M&T Realty Capital Corp.), Tony Love (Bellwether Affordable Housing Group), Anthony Weekly (Truist Bank) and David Battany (Guild Mortgage).

MBA, Trade Groups Urge Support of Housing Supply & Affordability Act

The Mortgage Bankers Association and a broad coalition of more than 100 national and regional trade associations and community support groups urged Congress to pass S. 5061, the Housing Supply and Affordability Act, a bipartisan bill that would authorize $1.5 billion over five years for federal grants to local governments that commit to increase their supply of local housing.

MBA: IMB Production Profits Remain Strong in Fourth Quarter

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net gain of $3,738 on each loan they originated in the fourth quarter down from a reported gain of $5,535 per loan in the third quarter, according to the Mortgage Bankers Association’s latest Quarterly Mortgage Bankers Performance Report.

Quote

“Cost-burdened individuals were more likely to work in the industries most susceptible to pandemic-related job loss and the ones who will have the most challenging roads to full recovery. As the country gets back on its feet, it is imperative that we not go back to a status quo that left too many Americans behind, many of the country’s renters cost burdened and our nation 7.3 million homes short of meeting housing needs.”

–From an MBA/coalition letter urging support of the Housing Supply and Affordability Act.

Fannie Mae Updates Servicer Toolkit

Fannie Mae, Washington, D.C., last week updated its Servicer Toolkit, providing new content and resources for mortgage servicers.

Fannie Mae Updates Servicer Toolkit

Fannie Mae, Washington, D.C., last week updated its Servicer Toolkit, providing new content and resources for mortgage servicers.

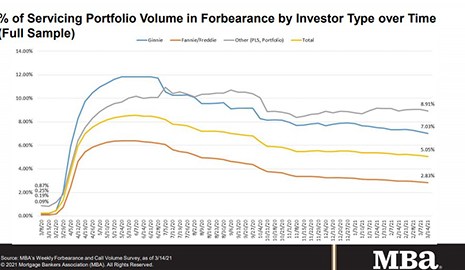

MBA: Share of Loans in Forbearance Falls to 5.05%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance fell by 9 percent to 5.05% of mortgage servicers’ portfolio volume as of March 14 from 5.14% the week earlier–the lowest level in nearly a year. MBA estimates 2.5 million homeowners are in forbearance plans.

MBA Urges Treasury, FHFA to Reconsider GSE Purchase Caps

The Mortgage Bankers Association on Monday asked for a meeting with Treasury and Federal Housing Finance Agency officials to address MBA member concerns over newly imposed limits on government-sponsored enterprise operations that could cause potential disruptions to the housing finance system.