The Mortgage Bankers Association recommended the Federal Housing Finance Agency align its actions on climate change and natural disaster risks with a set of core principles to reduce risk.

Category: News and Trends

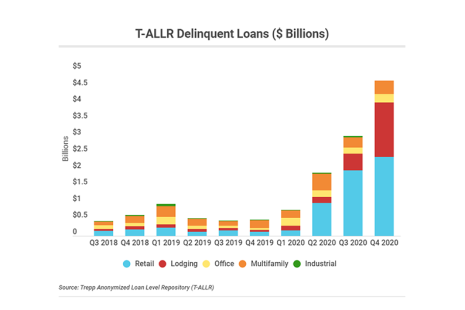

Trepp: 4Q Bank CRE Loan Data Show ‘Elevated Distress’

The U.S. economy is well into its recovery from the pandemic recession, but Trepp LLC, New York, noted bank commercial real estate loans indicated “elevated distress” in the fourth quarter.

MBA, Industry Groups Urge Use of American Rescue Plan Funds for Renters, Small Businesses

The Mortgage Bankers Association led more than two dozen other industry groups in an Apr. 15 letter to state and local policy associations, urging them to allocate available American Rescue Plan federal funds to assist renters, consumer-facing small businesses and impacted industries that are having trouble paying rents, mortgages or remaining viable enterprises due to the COVID-19 pandemic.

Nick Volpe: A Brief History of Defects; Q3 2020’s Loan Quality Performance Sets Stage for Areas of Concern in 2021

Lenders have a great deal to learn from their post-closing quality control analyses, even more so given the market disruptions and macroeconomic impact of COVID-19.

MBA Mortgage Action Alliance Call to Action Urges Flexibility on GSE Purchase Caps

The Mortgage Bankers Association’s grassroots advocacy arm, the Mortgage Action Alliance, issued a Call to Action last week, asking its members contact their members of Congress to allow flexibility in implementation of new purchase caps placed on Fannie Mae and Freddie Mac.

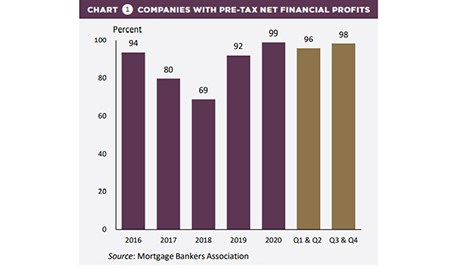

MBA: 2020 IMB Production Volumes, Profits Hit Record-Highs

Independent mortgage banks and mortgage subsidiaries of chartered banks made an average profit of $4,202 on each loan they originated in 2020, up from $1,470 per loan in 2019, the Mortgage Bankers Association reported last week.

Quote

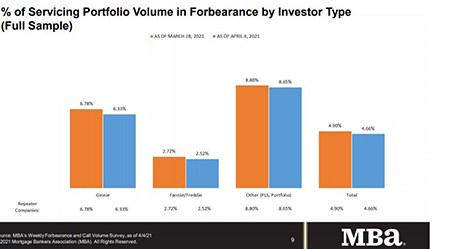

“Combined with the homeowner assistance and stimulus payments that many households are receiving, we expect that the forbearance numbers will continue to decline in the months ahead as more individuals regain employment.”

–MBA Chief Economist Mike Fratantoni.

‘Adapt and Pivot:’ MBA’s Marcia Davies and Elaine Howard on the MBA 2021 Spring Conference

When the full effects of the coronavirus pandemic began hitting in March 2020, the Mortgage Bankers Association quickly realized that life as usual—and business as usual—could take a long time to return to “normal.”

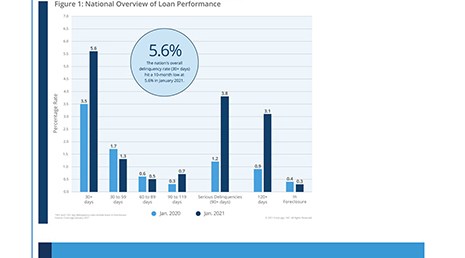

CoreLogic: Annual Mortgage Delinquency Rate Drops for 5th Straight Month to 10-Month Low

CoreLogic, Irvine, Calif., said while mortgage delinquencies rose month over month in January, overall delinquency rates fell for the fifth straight month to the lowest level since last March.

MBA: Loans in Forbearance Fall 6th Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 24 basis points to 4.66% of servicers’ portfolio volume as of Apr. 4, from 4.90% the prior week. MBA now estimates 2.3 million homeowners are in forbearance plans.