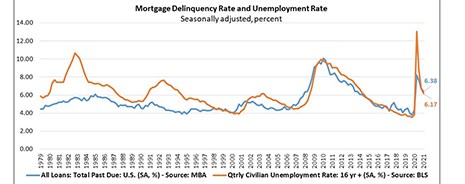

The Mortgage Bankers Association on Friday reported the delinquency rate for mortgage loans on one-to-four-unit residential properties fell to 6.38 percent of all loans outstanding, seasonally adjusted, at the end of the first quarter.

Category: News and Trends

Murali Tirupati: How Intelligent Automation Can Simplify Mortgage Origination, Boarding and Servicing

There are no easy answers to be found for legacy banks and those looking to grow their presence in the broader mortgage market, but the clue perhaps lies in the friction involved in existing mortgage processes.

Local Investors Drive Record Demand for Foreclosures

Auction.com, Irvine, Calif., reported more than three out of four distressed property buyers are local investors and nearly nine in 10 purchased five or fewer investment properties in 2020.

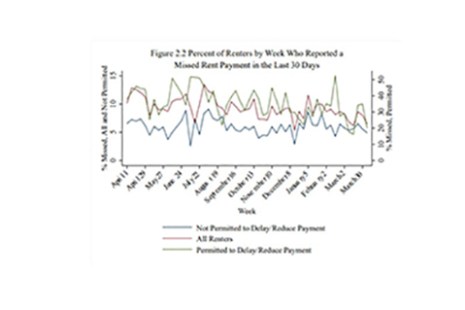

RIHA: Less Than 10% of Homeowners, Renters Have Missed Multiple Payments During Pandemic

Slightly under five million households did not make their rent or mortgage payments in March, an improvement from December 2020 and the lowest number since the onset of the COVID-19 pandemic, new research from the Mortgage Bankers Association’s Research Institute for Housing America reported.

CMBS Market Musings: Trophy Asset and Transitional Loan Transactions Thrive

The private-label CMBS market remains a mixed bag showing signs of a K-shaped recovery in the second quarter with delinquency and default numbers trending down now for nine consecutive months.

CFPB Reports Detail Mortgage Borrowers’ Continuing COVID-19 Challenges

The Consumer Financial Protection Bureau released two reports Tuesday, saying more work needs to be done to help mortgage borrowers coping with the COVID-19 pandemic and economic downturn.

Quote

“A rebounding job market and stimulus checks helped borrowers stay current on their mortgage payments. Mortgage delinquencies track closely to the U.S. unemployment rate, and with unemployment dropping from last year’s spike, many households appear to be doing better.” –Marina Walsh, CMB, MBA Vice President of Industry Analysis.

Black Knight: Delinquencies at Record Low: MBA to Release National Delinquency Survey Friday

Ahead of this Friday’s release of the Mortgage Bankers Association’s 1st Quarter National Delinquency Survey, Black Knight, Jacksonville, Fla., said just 217,000 homeowners became past due on their mortgages in March, the lowest such delinquency inflow of any month on record.

FHFA Publishes Final Rule on GSE ‘Living Wills’

The Federal Housing Finance Agency on Monday published a final rule that requires Fannie Mae and Freddie Mac to develop credible resolution plans, also known as “living wills.”

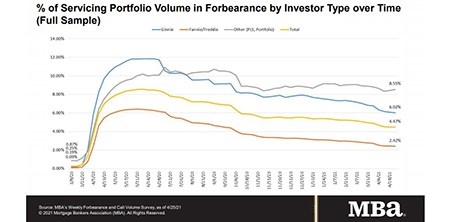

Share of Mortgage Loans in Forbearance Down 9th Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 2 basis points to 4.47% of servicers’ portfolio volume as of April 25 from 4.49% in the prior week, the ninth straight weekly decrease. MBA estimates 2.23 million homeowners are in forbearance plans.