The Mortgage Bankers Association and 10 other industry organizations commented on private flood insurance questions and answers published by regulatory agencies.

Category: News and Trends

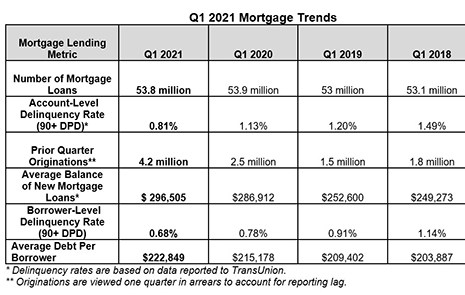

TransUnion: Consumer Credit Performance Improving, Demand Increasing

TransUnion, Chicago, said despite shockwaves felt from the COVID-19 pandemic, the consumer credit market is strongly positioned as many parts of the country prepare to enter new phases of re-opening this summer.

Quote

“The industry is not more difficult to originate in; it is absolutely wide open, which is why we are starting to see competing fintechs enter the home equity lending space. And values continue to rise which increases the potential for equity lending. We are not going to see market values slowdown anytime soon.”

–Omar Jordan, Founder & CEO of LenderClose, West Des Moines, Iowa.

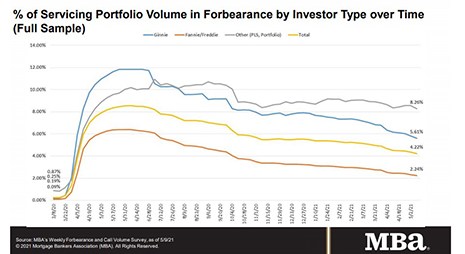

Share of Mortgage Loans in Forbearance Falls to 4.22%

Loans in forbearance fell for the 11th consecutive week to 4.22% of servicers’ portfolio volume as of May 9, the Mortgage Bankers Association reported Monday.

(The New Normal) Jane Mason: With Right Technology, Servicers Proved Remote Teams Can Excel

Mortgage servicing has certainly seen ups and downs over the years, although nothing compares to the level of upheaval that we saw last year—nor the speed at which it occurred. Out of the chaos, however, new opportunities to excel have emerged, and perhaps the biggest one of all has been the ability to run a remote workforce with success.

Home Equity ‘Pandemic-Resistant’

It’s a great time to be a homeowner: ATTOM Data Solutions, Irvine, Calif., said home equity rose sharply in the first quarter, with equity-rich properties in the U.S. outnumbering seriously underwater homes by a 7-1 margin.

MBA Letter Offers Recommendations on 2 House Bills

The Mortgage Bankers Association, in a May 12 letter to House Financial Services Committee leadership, expressed concerns with two bills currently under the Committee’s consideration and offered recommendations to improve those bills.

ATTOM: Foreclosure Activity Declines as Moratorium Hits One-Year Mark

ATTOM Data Solutions, Irvine, Calif., released its April U.S. Foreclosure Market Report, showing 11,810 U.S. properties with foreclosure filings — down 1 percent from a month ago and down 17 percent from a year ago.

#MBANAC21: The View From The House

Three senior House lawmakers–two retired, one retiring from Congress–stopped by MBA’s National Advocacy Conference to weigh in on housing, the economy and lessons learned.

MBA, NMSA Ask CFPB to Amend Servicing Rules

The Mortgage Bankers Association and the National Mortgage Servicing Association asked the Consumer Financial Protection Bureau to make several changes to its proposed rulemaking to amend Regulation X servicing rules.