Statement by MBA President and CEO Bob Broeksmit, CMB, regarding the announced changes to FHA’s calculation of student debt:

Category: News and Trends

The State of the Nation’s Housing: Millions Face Risk of Eviction or Foreclosure

Households that weathered the pandemic without financial distress are “snapping up” the limited supply of homes for sale, pushing up prices and excluding less-affluent buyers from homeownership, the Joint Center for Housing Studies at Harvard University reported Wednesday.

1st Quarter Home Flipping Rate at 21-Year Low; Profits Decline

ATTOM, Irvine, Calif., said home flipping activity fell in the first quarter to the lowest level since 2000.

ATTOM: May Foreclosure Starts Up 36% YOY

ATTOM, Irvine, Calif., reported 10,821 U.S. properties with foreclosure filings in May, down 8 percent from a month ago but up 23 percent from a year ago. Foreclosure starts, which represent the initial notice of default, grew by 36 percent year-over-year.

Quote

“Promoting safe and sustainable homeownership and closing the homeownership gap that exists within minority communities is my top priority as MBA’s 2021 Chair. The mortgage industry has an opportunity and a responsibility to open the door for those ready and able to buy a home.”

–Susan Stewart, 2021 MBA Chair and CEO of SWBC Mortgage Corp., on MBA’s participation in the Black Homeownership Collaborative, which aims to increase Black homeownership by 3 million households by 2030.

MBA: 1st Quarter Commercial/Multifamily Mortgage Debt Up 1.1%

Commercial and multifamily mortgage debt outstanding rose by $44.6 billion (1.1 percent) in the first quarter, the Mortgage Bankers Association’s latest Commercial/Multifamily Mortgage Debt Outstanding report said.

Share of Mortgage Loans in Forbearance Decreases to 4.04%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 12 basis points to 4.04% of servicers’ portfolio volume as of June 6 from 4.16% the prior week–the 15th consecutive week of declines. MBA estimates 2 million homeowners are in forbearance plans.

MBA, Real Estate Industry Commend Administration for Recovery Efforts; Call for End to Nationwide Eviction Moratorium

The Mortgage Bankers Association and a broad real estate coalition on Friday commended measures President Biden has taken to stabilize the housing sector and urged the administration to sunset the federal moratorium on evictions on June 30.

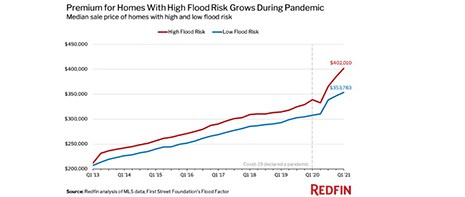

Despite Risk, Homes in High-Flood Areas Flying Off the (Continental) Shelves

Hurricane seasons and climate change are threatening to redraw coastal U.S. maps. But it’s not stopping homebuyers from chasing down waterfront properties.

Call for Speakers: MBA Risk Management, QA & Fraud Prevention Forum–Deadline June 29

Full session and individual speaker proposals are now being accepted for the Mortgage Bankers Association’s Risk Management, QA and Fraud Prevention Forum 2021, taking place Sept. 28–29 via MBA LIVE.