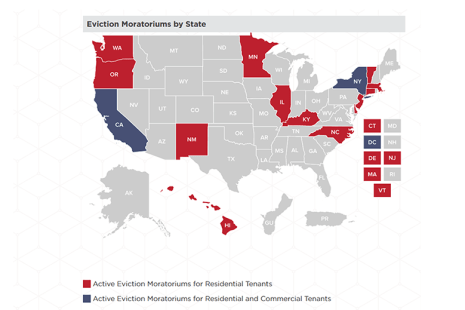

The Centers for Disease Control and Prevention on Thursday extended its nationwide residential eviction moratorium by another month, to July 31.

Category: News and Trends

Biden Administration Nominates Julia Gordon as FHA Commissioner; Dave Uejio as HUD Assistant Secretary

The Biden Administration on Friday nominated Julia Gordon as FHA Commissioner and announced Dave Uejio, who has been serving as Acting Director of the Consumer Financial Protection Bureau, has been nominated as HUD Assistant Secretary for Fair Housing and Equal Opportunity.

White House Names Sandra L. Thompson Acting FHFA Director

The White House appointed Sandra L. Thompson as Acting Director of the Federal Housing Finance Agency effective immediately.

TransUnion: Majority of Consumers in Accommodation Programs Continue to Make Payments

Enrollment in financial hardship programs grew significantly as a result of the COVID-19 pandemic – to 7% of all accounts for credit products such as auto loans and mortgages. However, a new TransUnion study reported the majority of consumers continued to make payments on their accounts, even when in an accommodation program.

Quote

“MBA recognizes and appreciates the impact of the Supreme Court’s decision in Collins v. Yellen as FHFA plays a critical role regulating entities that ensure liquid markets for single-family and multifamily mortgages…we look forward to working collaboratively with the administration, FHFA and other stakeholders to ensure those markets function well for lenders and the American consumers they serve.”

–MBA President & CEO Robert Broeksmit, CMB.

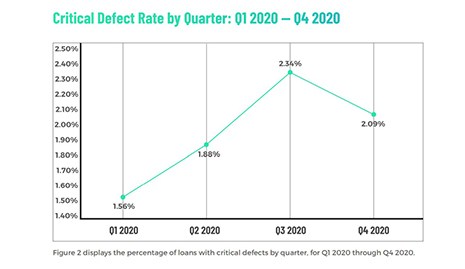

ACES: Q4 Critical Defect Rate Moderates, But Remains High

ACES Quality Management, Denver, said overall critical defect rates improved in the fourth quarter but remained high for calendar year 2020.

Most Senior CMBS Found ‘Resilient’ Under Stress Test

Most high investment-grade rated commercial mortgage-backed securities multi-borrower bonds can withstand downgrades under a new hypothetical stress test, Fitch Ratings reported last week.

MBA, Lenders Seeks Clarity on Juneteenth Holiday Designation

With unusual speed and rare bipartisan agreement, Congress last week passed, and President Biden signed, legislation designating June 19—colloquially known as “Juneteenth”—a federal holiday, a move welcomed by Americans and supported by the Mortgage Bankers Association and thousands of businesses nationwide. But the speed of the designation—with Friday, June 18 designated a federal holiday—resulted in unintended consequences and disruption for the mortgage lending industry.

MBA Endorses Plan to Significantly Increase Black Homeownership by 2030

The Mortgage Bankers Association endorsed an announcement by the Black Homeownership Collaborative to close the Black homeownership gap through its 7-point plan – a solutions-based initiative to increase Black homeownership by 3 million net new households by 2030.

MBA Statement on Changes to FHA’s Calculation of Student Debt

Statement by MBA President and CEO Bob Broeksmit, CMB, regarding the announced changes to FHA’s calculation of student debt: