The Consumer Financial Protection Bureau on Monday finalized amendments to federal mortgage servicing regulations in response to federal foreclosure moratoria phasing out later this summer.

Category: News and Trends

MBA RIHA Study: Older Homeowners, College-Educated Individuals More Likely to Leave Workforce After Job Loss

Older college-educated homeowners are two times more likely to leave the workforce after a job loss than renters, according to a new research report released Tuesday by the Mortgage Bankers Association’s Research Institute for Housing America.

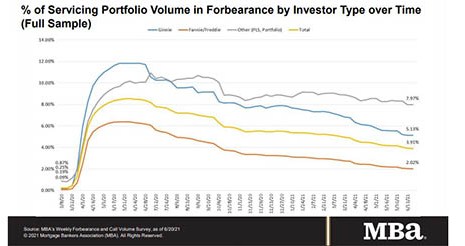

MBA: Share of Mortgage Loans in Forbearance Falls 17th Straight Week

Loans in forbearance fell for the 17th straight week–and for the second straight week, remained below 4 percent–the Mortgage Bankers Association reported Monday.

Black Knight: Past-Due Loans Continue to Improve

Black Knight, Jacksonville, Fla., said the national delinquency rate rose to 4.73% from 4.66% in April, although the increase was driven largely by the three-day Memorial Day weekend foreshortening available payment windows.

Despite Record Low Rates, Most Homeowners Pass on Refinancing

A Zillow survey of more than 1,300 homeowners found despite record low interest rates, more than three-fourths of respondents passed up the opportunity to refinance their mortgage.

Supreme Court Rules FHFA Director ‘Removable at Will;’ Calabria Out

The Supreme Court on Wednesday ruled that the structure of the Federal Housing Finance Agency is unconstitutional, allowing the President to remove its director at will. Shortly after the ruling, The Biden Administration removed Mark Calabria as FHFA Director.

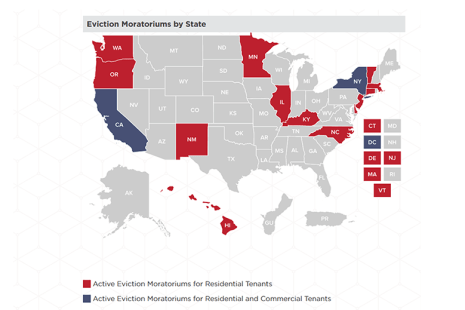

CDC Extends National Residential Eviction Moratorium for Final Time to July 31

The Centers for Disease Control and Prevention on Thursday extended its nationwide residential eviction moratorium by another month, to July 31.

Biden Administration Nominates Julia Gordon as FHA Commissioner; Dave Uejio as HUD Assistant Secretary

The Biden Administration on Friday nominated Julia Gordon as FHA Commissioner and announced Dave Uejio, who has been serving as Acting Director of the Consumer Financial Protection Bureau, has been nominated as HUD Assistant Secretary for Fair Housing and Equal Opportunity.

White House Names Sandra L. Thompson Acting FHFA Director

The White House appointed Sandra L. Thompson as Acting Director of the Federal Housing Finance Agency effective immediately.

TransUnion: Majority of Consumers in Accommodation Programs Continue to Make Payments

Enrollment in financial hardship programs grew significantly as a result of the COVID-19 pandemic – to 7% of all accounts for credit products such as auto loans and mortgages. However, a new TransUnion study reported the majority of consumers continued to make payments on their accounts, even when in an accommodation program.