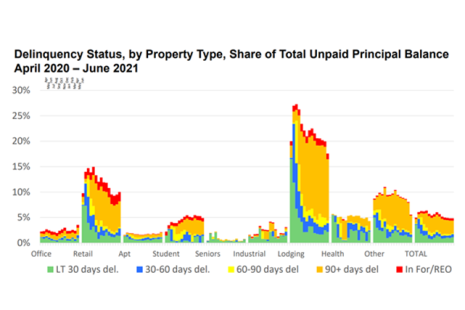

Delinquency rates for mortgages backed by commercial and multifamily properties held steady in June, the Mortgage Bankers Association’s latest monthly CREF Loan Performance Survey said.

Category: News and Trends

Quote

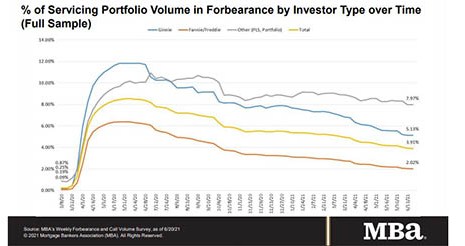

“Forbearance exits increased in the week of the July 4 holiday to the fastest pace since early April. New requests stayed very low, resulting in a large drop in the share of loans in forbearance, particularly for Ginnie Mae loans, which also continue to be impacted by buyouts of delinquent loans. These loans are tracked as portfolio loans after a buyout.”

–Mike Fratantoni, MBA Senior Vice President and Chief Economist.

MBA Urges Federal Agencies to Clarify How AI Technologies Apply to Regs

The Mortgage Bankers Association last week asked federal regulatory agencies to clarify how existing fair lending and the Equal Credit Opportunity Act adverse action notification requirements apply to Artificial Intelligence technologies.

CFPB Report Finds ‘Wide-Ranging Violations of Law’ in 2020

The Consumer Financial Protection Bureau this week issued a report highlighting legal violations identified by the Bureau’s examinations in 2020.

MBA Letter Urges Senate Support of Julia Gordon Nomination as FHA Commissioner

The Mortgage Bankers Association urged the Senate Banking Committee to quickly approve Julia Gordon’s nomination as FHA Commissioner and forward her nomination for a full Senate vote.

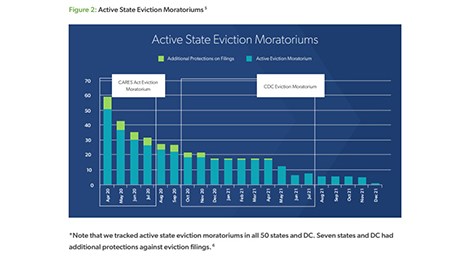

Grant Carlson: The June 29 Supreme Court Ruling on CDC Residential Eviction Moratorium

On Tuesday the U.S. Supreme Court in, a 5-4 ruling, declined to lift the national Center for Disease Control and Prevention’s residential eviction moratorium. The ruling responds to a request to lift the D.C. Federal District Court’s stay, which has effectively paused its order invalidating the CDC moratorium.

Freddie Mac: Moratoria Staved Off Eviction Crisis During Pandemic

Freddie Mac, McLean Va., said federal and local moratoria in response to the COVID-19 pandemic largely prevented an eviction crisis involving property renters—but the amount of back rent still owed is a “concerning factor” going forward.

Quote

“Artificial intelligence and related technologies, including machine learning have the potential to provide substantial benefits for participants in the mortgage lending industry and the consumers they serve. AI has particular potential in the area of credit underwriting where it can it be combined with alternative or non-traditional data to expand access to affordable (and sustainable) mortgage credit. Despite these benefits, broad adoption of AI has been slowed by uncertainty surrounding how AI fits within a regulatory framework that was largely created before its development.

–Pete Mills, MBA Senior Vice President of Residential Policy and Member Engagement.

MBA: Share of Mortgage Loans in Forbearance Falls 17th Straight Week

Loans in forbearance fell for the 17th straight week–and for the second straight week, remained below 4 percent–the Mortgage Bankers Association reported Monday.

Ginnie Mae to Add 40-Year Securitizations

Ginnie Mae announced creation of a new pool type to support securitization of modified loans with terms up to 40 years.