The Consumer Financial Protection Bureau published an issue brief showing consumer applications for auto loans, new mortgages and revolving credit cards had mostly returned to pre-pandemic levels by May.

Category: News and Trends

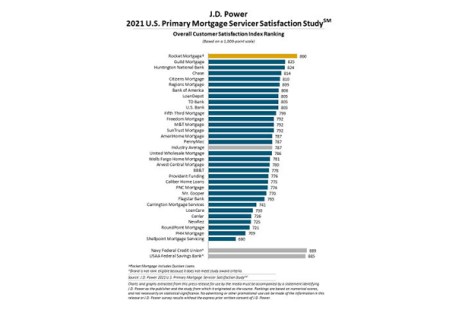

J.D. Power: Mortgage Servicers Get High Marks; Nonbanks Gain Traction

J.D. Power, Troy, Mich., said mortgage servicers earned high levels of customer satisfaction during the pandemic, but warned as loan forbearance programs come to an end and more normalized customer interactions resume, traditional banks are starting to lose their edge over non-bank lenders.

MBA Supports CSBS Prudential Standards for Nonbank Mortgage Servicers

Last Tuesday the Conference of State Bank Supervisors released model state regulatory prudential standards for nonbank mortgage servicers. MBA President and CEO Bob Broeksmit, CMB, immediately expressed support for the standards.

MBA, Trade Groups Urge Senate Confirmation of Julia Gordon as FHA Commissioner

The Mortgage Bankers Association and nearly three dozen industry trade groups sent a letter to Senate leadership urging confirmation of Julia Gordon as HUD Assistant Secretary for Housing and Commissioner of the Federal Housing Administration.

Quote

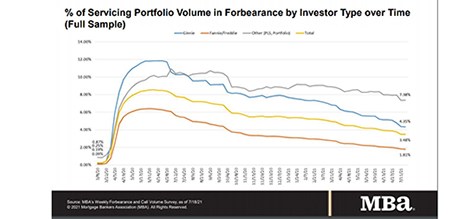

“Forbearance exits remained low, and there was another increase in new forbearance requests, particularly for Ginnie Mae and portfolio and private-label securities loans. The net result was another slight decline in the share of loans in forbearance.” –MBA Senior Vice President and Chief Economist Mike Fratantoni.

MBA MAA ‘Call to Action’ on GSE ‘G-Fees’

The Mortgage Bankers Association’s grassroots advocacy arm, the Mortgage Action Alliance, issued a ‘Call to Action’ on Monday to its 70,000-plus members urging them to tell their elected officials to not use government-sponsored enterprise guaranty fees (g-fees) as a source of funding offsets.

Share of Mortgage Loans in Forbearance Slightly Dips to 3.48%

Loans in forbearance fell for the 21st consecutive week, the Mortgage Bankers Association said on Monday.

FHA Establishes New, Streamlined COVID-19 Recovery Loss Mitigation Options

The Federal Housing Administration on Friday published Mortgagee Letter 2021-18, COVID-19 Recovery Loss Mitigation Options. The ML outlines assistance for homeowners who have been financially impacted by the COVID-19 pandemic to remain in their homes with new, streamlined loss mitigation options.

MBA, Trade Groups Reiterate Opposition to G-Fee Offsets

Fresh off of last week’s regulatory victory in which the Federal Housing Finance Agency withdrew its controversial adverse market refinance fee, the Mortgage Bankers Association and several dozen industry trade groups took fresh aim at another controversial practice—a move in Congress to use the government-sponsored enterprises’ guaranty fees—known as “g-fees”—to offset funding for non-housing programs.

Black Knight: 1.55 Million Serious Delinquencies Nag Market

Black Knight, Jacksonville, Fla., said the national delinquency rate hit its lowest level since the onset of the pandemic in June and is now back below its pre-Great Recession average. Despite the improvement, more than 1.5 million homeowners remain 90 or more days past due on their mortgages but who are not in foreclosure, still nearly four times pre-pandemic levels.