ATTOM, Irvine, Calif., found 34.4 percent of mortgaged residential properties in the United States were considered “equity-rich” in the second quarter, up from 27.5 percent a year before.

Category: News and Trends

July Commercial/Multifamily Mortgage Delinquencies Decline

Delinquency rates for mortgages backed by commercial and multifamily properties declined in July, the Mortgage Bankers Association’s latest CREF Loan Performance Survey reported.

RIHA: Fewer Households Missed Housing Payments in Second Quarter

Slightly under five million households did not make their rent or mortgage payments in the second quarter, updated research from the Mortgage Bankers Association’s Research Institute for Housing America reported.

CDC Issues New Residential Eviction Moratorium Through Oct. 3

The Centers for Disease Control and Prevention issued a new order temporarily halting residential evictions through October 3 in U.S. counties with “heightened levels of community [COVID-19] transmission.”

Quote

“MBA will continue to oppose any attempts at legislative or regulatory change pertaining to the Fair Credit Act that reduces access to credit and leads to higher costs of FHA financing for first-time, low- to moderate-income and minority homebuyers.”

–Bill Killmer, MBA Senior Vice President for Legislative and Political Affairs.

Seth Appleton: How MISMO Standards Are Helping The Industry Achieve Higher Tech Adoption

At the recently concluded MISMO Spring Summit–which set an attendance record for the organization–two related themes emerged during many of the event’s “Going Digital” sessions. Experts throughout the four-day event agreed that technology adoption and data trust are two business challenges that must be solved so the industry can truly “go digital” and realize the benefits that come along with it.

Paul Anselmo of Evolve Mortgage Services: Defragmenting the Digital Closing Process

Paul Anselmo is CEO and founder of Evolve Mortgage Services, Frisco, Texas, a provider of outsourced mortgage platforms. He has more than 30 years of experience in the banking and mortgage industries. Previously he served as president, CEO and founder of Mortgage Resource Network (MRN), a business process outsourcer and technology provider to the mortgage industry.

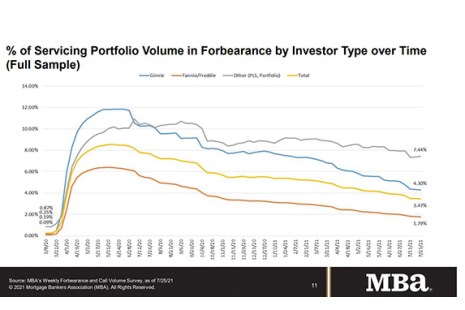

Share of Mortgage Loans in Forbearance Slightly Decreases

Loans in forbearance fell for the twenty-second consecutive week, the Mortgage Bankers Association said on Monday.

MISMO’s Jan Davis Receives HousingWire Woman of Influence Award

MISMO®, the real estate finance industry’s standards organization, announced Vice President of Operations Jan Davis received a HousingWire 2021 Woman of Influence award.

FHFA, FHA Extend Single-Family Eviction Moratoria through Sept. 30

The Federal Housing Finance Agency and the Federal Housing Administration on Friday extended their eviction moratoria through Sept. 30 for foreclosed borrowers and other occupants.