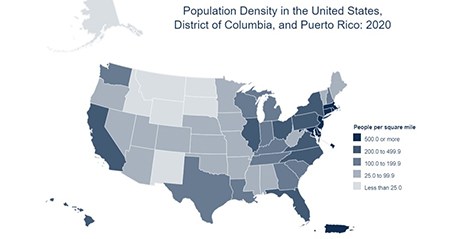

The Census Bureau last week released preliminary results from its 2020 Census, showing a United States in the midst of demographic transition.

Category: News and Trends

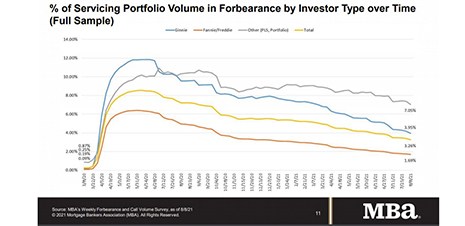

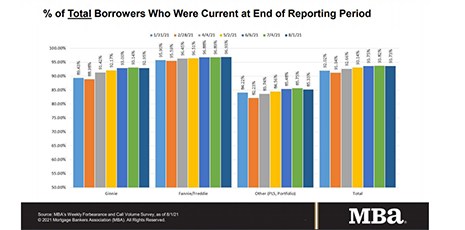

Share of Mortgage Loans in Forbearance Decreases to 3.26%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 14 basis points to 3.26% of servicers’ portfolio volume as of August 8 from 3.40% the previous week. MBA now estimates 1.6 million homeowners are in forbearance plans.

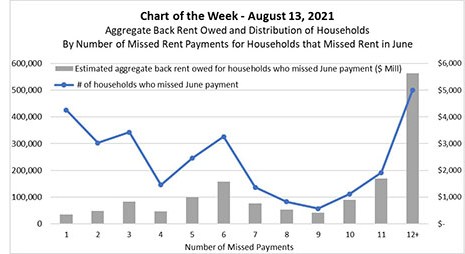

MBA Chart of the Week Aug. 16 2021–Aggregate Back Rent Owed

This week’s MBA Chart of the Week zeroes in on households who missed rental payments in June. The chart plots a) the distribution of those households by the number of payments they have missed since the onset of the pandemic; and b) an estimate of the aggregate dollar volume of back rent owed by those households.

July Foreclosure Activity Dips Slightly

ATTOM, Irvine, Calif., released its July U.S. Foreclosure Market Report, showing 12,483 U.S. properties with foreclosure filings, down 4 percent from a month ago but up 40 percent from a year ago.

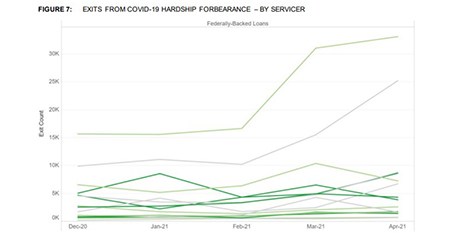

CFPB: Mortgage Servicers’ Pandemic Response Varies Significantly

The Consumer Financial Protection Bureau on Tuesday published a report detailing 16 large mortgage servicers’ COVID-19 pandemic response. The report showed a disparate response in call metrics, exit metrics and other measures.

Quote

“Many homeowners are nearing the end of their forbearance terms. The forbearance share declined for all investor and servicer categories. New forbearance requests picked up slightly this week, particularly for Ginnie Mae loans, but overall trends remain positive. Incoming data continues to support our forecast of an improving job market in the months ahead.” –Mike Fratantoni, MBA Senior Vice President and Chief Economist.

CoreLogic: Mortgage Fraud Increases After Earlier Dip

CoreLogic, Irvine, Calif., reported mortgage fraud is increasing again after a brief dip last year.

MBA Shares Concerns with Ginnie Mae on Eligibility Requirements for Single-Family MBS Issuers

The Mortgage Bankers Association shared recommendations and concerns with Ginnie Mae regarding proposed changes to eligibility requirements for single-family mortgage-backed security issuers.

MBA, Trade Groups Oppose Amendment Altering False Claims Act

As the Senate plods toward what appears to be eventual passage of a massive infrastructure framework, the Mortgage Bankers Association and several other industry trade groups expressed opposition to an amendment that would unfavorably alter the False Claims Act.

Share of Mortgage Loans in Forbearance Decreases to 3.40%

New forbearance requests fell to a three-week low, the Mortgage Bankers Association reported Monday.