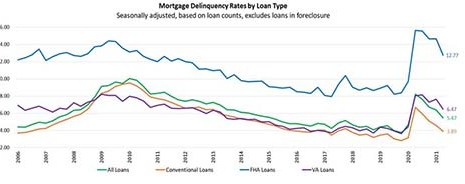

The Mortgage Bankers Association on Thursday released its Second Quarter National Delinquency Survey, showing the delinquency rate for mortgage loans on one-to-four-unit residential properties fell to a seasonally adjusted rate of 5.47 percent of all loans outstanding—the lowest rate since first-quarter 2020.

Category: News and Trends

Call for Speakers: MBA Servicing Solutions Conference & Expo 2022—Deadline Sept. 13

Speaking proposals are now being accepted for the Mortgage Bankers Association’s Servicing Solutions Conference & Expo 2022, taking place February 22-25 in Orlando, Fla. This event is the largest gathering of mortgage servicers each year.

Fewer Than 1 in 5 With Pre-Pandemic Mortgages Have Refinanced

Despite record low interest rates, just 19 percent of homeowners with a mortgage they had prior to the pandemic have refinanced since COVID-19 started, according to Bankrate.com.

Retail Sales, Store Openings Could Boost Retail Property Loan Performance

Moody’s Investors Service, New York, said rebounding retail sales and new store openings should boost retail property loan performance.

FHFA Raises Proposed 2022-2024 Housing Goals for Fannie Mae, Freddie Mac

Fannie Mae and Freddie Mac have new homework assignments from the Federal Housing Finance Agency, which raise the stakes considerably for the government-sponsored enterprises’ 2022-2024 affordable housing goals

Quote

“It appears that borrowers in later stages of delinquency are recovering due to several factors, including improved employment and other economic conditions, the availability of home retention workout options after forbearance and a strong housing market that is bringing additional alternatives to distressed homeowners.”

–Marina Walsh, CMB, MBA Vice President of Industry Analysis.

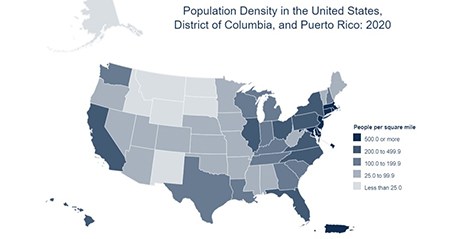

The New Census Figures: a Breakdown

The Census Bureau last week released preliminary results from its 2020 Census, showing a United States in the midst of demographic transition.

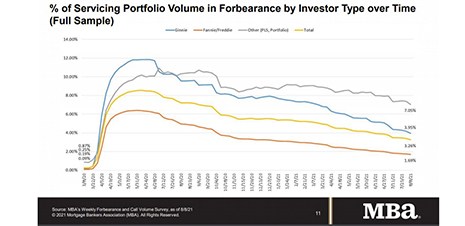

Share of Mortgage Loans in Forbearance Decreases to 3.26%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 14 basis points to 3.26% of servicers’ portfolio volume as of August 8 from 3.40% the previous week. MBA now estimates 1.6 million homeowners are in forbearance plans.

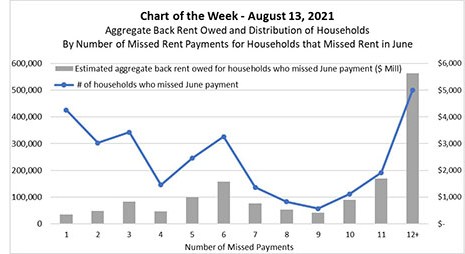

MBA Chart of the Week Aug. 16 2021–Aggregate Back Rent Owed

This week’s MBA Chart of the Week zeroes in on households who missed rental payments in June. The chart plots a) the distribution of those households by the number of payments they have missed since the onset of the pandemic; and b) an estimate of the aggregate dollar volume of back rent owed by those households.

July Foreclosure Activity Dips Slightly

ATTOM, Irvine, Calif., released its July U.S. Foreclosure Market Report, showing 12,483 U.S. properties with foreclosure filings, down 4 percent from a month ago but up 40 percent from a year ago.