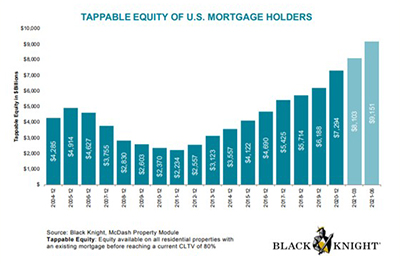

Driven by the red-hot housing market, tappable equity – the amount available to homeowners before reaching a maximum 80% combined loan-to-value ratio – surged nearly 40% from last year to a record $9.1 trillion in the second quarter, said Black Knight, Jacksonville, Fla.

Category: News and Trends

MBA Education Graduates First Level III Certified Mortgage Compliance Professional

MBA Education’s popular Certified Mortgage Compliance Professional certification and designation program recently awarded the CMCP designation to the first mortgage professional to complete all three levels of the program.

FHFA Announces Equitable Housing Finance Plans for GSEs

The Federal Housing Finance Agency announced Tuesday that Fannie Mae and Freddie Mac will submit Equitable Housing Finance Plans by the end of 2021.

Quote

“Servicer call volume jumped last week as summer came to an end and many borrowers reached the end of their forbearance terms. We anticipate a similarly fast pace of exits in the weeks ahead, which should lead to increased call volume and a further decline in the forbearance share.”

–Mike Fratantoni, MBA Senior Vice President and Chief Economist.

Real Estate Investment Trusts Poised For Recovery

S&P Global Ratings, New York, said real estate investment trust earnings rebounded significantly in the second quarter, demonstrating the sector is on the right path for a solid comeback.

FHA Announces Temporary Partial Waivers to HECM Policy

FHA on Thursday issued temporary partial waivers to its Home Equity Conversion Mortgage (HECM) policies. These waivers provide mortgagees with expanded flexibility to help senior homeowners with HECMs who are struggling financially due to COVID-19.

CoreLogic: Hurricane Ida Leaves $27-40 Billion in Losses

CoreLogic, Irvine, Calif., estimated residential and commercial wind, storm surge and inland flooding loss estimates for Hurricane Ida in Louisiana, Mississippi and Alabama at $27-$40 billion.

CFPB Proposed Rule Focuses on Small Business Access to Credit

The Consumer Financial Protection Bureau on Wednesday proposed a new rule aimed at increasing transparency in the small business lending marketplace.

Administration Announces Steps to Increase Affordable Housing Supply

The Biden Administration on Wednesday announced a number of steps aimed at creating, preserving and selling to homeowners and non-profits nearly 100,000 additional affordable homes for homeowners and renters over the next three years, with an emphasis on the lower and middle segments of the market.

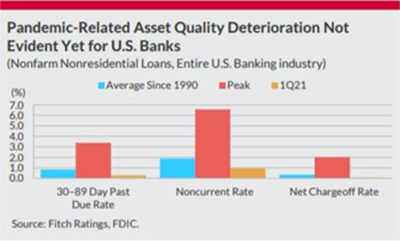

Fitch Ratings: Small U.S. Banks Most Exposed to Commercial Real Estate Losses

Fitch Ratings, Chicago, said the U.S. commercial real estate market will likely see deteriorating credit metrics once stimulus measures wind down and forbearance programs expire, with smaller CRE-concentrated banks more susceptible to elevated losses, which are expected to peak below levels seen in the past.