Leaders need to include software audits in their strategic planning process. A good software audit sets the stage for effective budgeting and decision making this fall. Leaders should analyze the company’s current Application Programming Interface integrations to existing mortgage software.

Category: News and Trends

CMBS Delinquency Rate Shrinks, Cumulative Default Rate Increases

The commercial mortgage-backed securities delinquency rate continues to shrink, but the cumulative loan default rate increased slightly in first-half 2021, according to two new reports from S&P Global Ratings and Fitch Ratings.

CoreLogic Report Finds Idaho, Wyoming at Disproportionate Economic Risk for Wildfire

You’d think that when analyzing wildfire risk, California would be at the top. But a CoreLogic analysis of additional factors, such as reconstruction resources and economic recovery potential, found that Idaho and Wyoming are the states at most risk.

Broeksmit: MBA ‘Working Hard for You’

Mortgage Bankers Association President & CEO Robert Broeksmit, CMB, kicked off the MBA Risk Management, QA and Fraud Prevention Forum with a tacit acknowledgement that the past year has been the busiest for the real estate finance industry in years.

Quote

“The mortgage industry will not be spared by the growing impact climate change is having on the environment, governments and individuals…Climate mitigation efforts are necessary to slow the adverse effects of global warming, and better and more standardized predictors of environmental risks are needed to make housing and housing finance more resilient.”

–Sean Becketti, author of a RIHA report on the effects on climate change on the real estate finance industry.

FHA Adds COVID-19 Forbearance Relief Options

The Federal Housing Administration on Sept. 27 announced new and extended COVID-19 relief options for borrowers recently or newly struggling to make their mortgage payments because of the pandemic and for senior homeowners with Home Equity Conversion Mortgages who need assistance to remain in their homes.

MBA: 2Q Commercial/Multifamily Mortgage Debt Outstanding Up 1.5%

Commercial/multifamily mortgage debt outstanding increased by $60.7 billion (1.5 percent) in the second quarter, according to the Mortgage Bankers Association’s latest Commercial/Multifamily Mortgage Debt Outstanding report.

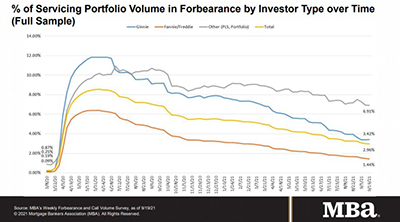

MBA: Loans in Forbearance Fall Under 3%

Loans in forbearance fell to under 3 percent for the first time since March 2020, the Mortgage Bankers Association reported Monday.

FHFA Extends COVID-19 Multifamily Forbearance

The Federal Housing Finance Agency said Fannie Mae and Freddie Mac will continue to offer COVID-19 forbearance to qualifying multifamily property owners as needed, subject to tenant protections the agency imposed during the pandemic.

MISMO Fall Summit: Building Confidence and Efficiency into Non-Agency Data Exchanges

CRYSTAL CITY, VA.–An efficient private-label securities market requires that investors have confidence in their understanding of asset quality for their deals. But questions remain, according to panelists here at the MISMO Fall Summit–and ongoing work under the auspices of MISMO is poised to help provide much-needed data standardization.