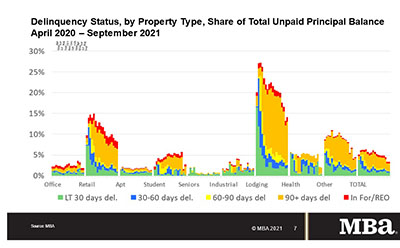

Delinquency rates for mortgages backed by commercial and multifamily properties declined in September, the Mortgage Bankers Association’s latest CREF Loan Performance Survey reported.

Category: News and Trends

Quote

“Commercial and multifamily mortgage performance has improved considerably since the worst of the downturn. The stress that entered–and remains–in the market is largely concentrated in lodging and retail properties, with fewer new loans becoming delinquent and shrinking balances of overall delinquency as lenders and servicers work out the longer-term troubled loans.”

–Jamie Woodwell, MBA Vice President of Commercial Real Estate Research.

RMQA21: Risk Managers Weigh In

WASHINGTON, D.C.–Risk managers worked hard to maintain operations, employee morale and productivity when the pandemic hit, top risk management executives said during the recent Mortgage Bankers Association Risk Management, QA and Fraud Prevention Forum 2021.

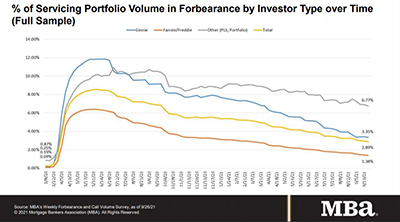

Share of Mortgage Loans in Forbearance Decreases to 2.89%

Loans in forbearance continued their downward trend, the Mortgage Bankers Association reported Monday, and the number of homeowners in forbearance plans fell below 1.5 million.

RMQA21 Fraud Update: ‘Be Alert For Red Flags’

WASHINGTON, D.C.–The mortgage industry needs to be prepared for increased fraud activity as the pandemic and the recession fade, law enforcement, legal and mortgage servicing analysts said at the recent Mortgage Bankers Association’s Risk Management, QA and Fraud Prevention Forum 2021.

RMQA21: Pandemic Saw Changes in Consumer Behavior—Most of it Good

WASHINGTON, D.C.—The economy continued to improve in 2021, fueled by record consumer savings and strong gains in employment, despite the coronavirus pandemic that could have otherwise ground it to a halt, said Emre Sahingur, Senior Vice President of Predictive Analytics with VantageScore Solutions LLC, Stamford, Conn.

Jeff Williams of FICS: Support Strategic Planning with Audit of Mortgage Software, API Capabilities

Leaders need to include software audits in their strategic planning process. A good software audit sets the stage for effective budgeting and decision making this fall. Leaders should analyze the company’s current Application Programming Interface integrations to existing mortgage software.

CMBS Delinquency Rate Shrinks, Cumulative Default Rate Increases

The commercial mortgage-backed securities delinquency rate continues to shrink, but the cumulative loan default rate increased slightly in first-half 2021, according to two new reports from S&P Global Ratings and Fitch Ratings.

CoreLogic Report Finds Idaho, Wyoming at Disproportionate Economic Risk for Wildfire

You’d think that when analyzing wildfire risk, California would be at the top. But a CoreLogic analysis of additional factors, such as reconstruction resources and economic recovery potential, found that Idaho and Wyoming are the states at most risk.

Broeksmit: MBA ‘Working Hard for You’

Mortgage Bankers Association President & CEO Robert Broeksmit, CMB, kicked off the MBA Risk Management, QA and Fraud Prevention Forum with a tacit acknowledgement that the past year has been the busiest for the real estate finance industry in years.