SAN DIEGO—Mortgage Bankers Association Chairman Kristy Fercho on Monday announced the Home for All Pledge, an MBA member company action pledge to promote minority homeownership, affordable rental housing and company diversity, equity and inclusion.

Category: News and Trends

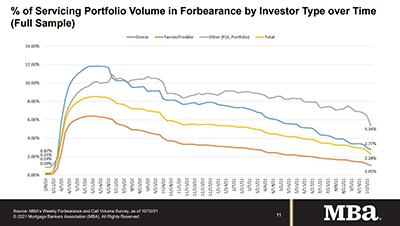

Share of Mortgage Loans in Forbearance Decreases to 2.28%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 34 basis points to 2.28% as of October 10.

HUD, FHFA Heads Zero in On Housing Affordability, Appraisals

SAN DIEGO—Few people have had the kind of impact off the bat than HUD Secretary Marcia Fudge and Federal Housing Finance Agency Acting Director Sandra Thompson.

MBA Forecast: 2022 Purchase Originations to Increase 9% to Record $1.7 Trillion

SAN DIEGO–The Mortgage Bankers Association said purchase mortgage originations are expected to grow 9% to a record $1.725 trillion in 2022.

Freddie Mac: Single Women Have Low Confidence in Homeownership Prospects

Freddie Mac, McLean, Va., reported nearly 60 percent of single female head-of-household renters feel homeownership is out of reach indefinitely.

ATTOM: Foreclosure Activity Sees Uptick as Moratoria Lift

ATTOM, Irvine, Calif., said third-quarter foreclosure filings rose by 34 percent from the second quarter and by 68 percent from a year ago.

FHFA Increases Fannie Mae, Freddie Mac Multifamily Loan Purchase Caps

The Federal Housing Finance Agency on Wednesday increased the 2022 multifamily loan purchase caps for Fannie Mae and Freddie Mac to $78 billion each.

Kumar Alok Upadhyay of HCL Technologies: Redefining the Future of Lending Solutions

The pandemic was a major lesson that taught businesses to stay prepared for the uncertain future. So, let’s get into the minds and hearts of the lenders and borrowers, and identify which factors could help sustain the lending business in the coming decade.

Quote

“More newly built homes and more homeowners listing their homes for sale should lead to some deceleration in home-price growth next year. This is good news for the many would-be buyers who are currently priced out or delaying decisions because of low supply conditions and steep home-price appreciation.”

–MBA Chief Economist Mike Fratantoni.

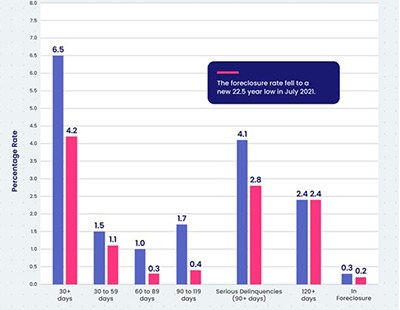

CoreLogic: Delinquency Rates Approach Pre-Pandemic Levels

CoreLogic, Irvine, Calif., said delinquency rates on all mortgages in the U.S. fell in July to the lowest rates since March, edging closer to pre-pandemic levels.