The Mortgage Bankers Association sent a letter of support last week To Sen. Tim Scott, R-S.C., who introduced a bill would prevent the Internal Revenue Service and the Treasury Department from imposing unusual reporting requirements on financial services providers to track and submit customer account information.

Category: News and Trends

MBA Offers Recommendations on FHFA GSE Equitable Housing Finance Plans

The Mortgage Bankers Association last week sent a letter to the Federal Housing Finance Agency, offering recommendation to improve Fannie Mae and Freddie Mac’s efforts to address long-standing challenges related to housing equity and the racial homeownership gap.

MBA Servicing Solutions Conference & Expo in Orlando Feb. 22-25

The Mortgage Bankers Association’s Servicing Solutions Conference & Expo 2022 takes place Feb. 22-25 at the Hyatt Regency Orlando.

Quote

“The Treasury Department’s new tax information reporting plan, if enacted into law as part of the proposed reconciliation package under discussion, would capture many routine mortgage-related transactions, result in significantly increased tax compliance costs for individuals, families and small businesses, and present privacy concerns regarding potential data breaches.”

–MBA Senior Vice President of Legislative and Political Affairs Bill Killmer, in a letter of support to Sen. Tim Scott, R-S.C., for introducing a bill that would prevent the IRS from imposing “draconian” reporting requirements on financial services providers.

MBA Servicing Solutions Conference & Expo in Orlando Feb. 22-25

The Mortgage Bankers Association’s Servicing Solutions Conference & Expo 2022 takes place Feb. 22-25 at the Hyatt Regency Orlando.

MBA Forecast: 2022 Purchase Originations to Increase 9% to Record $1.7 Trillion

SAN DIEGO–The Mortgage Bankers Association said purchase mortgage originations are expected to grow 9% to a record $1.725 trillion in 2022.

MBA Launches Member Action Pledge to Promote Minority Homeownership, Affordable Rental Housing, DEI

SAN DIEGO—Mortgage Bankers Association Chairman Kristy Fercho announced the Home for All Pledge, an MBA member company action pledge to promote minority homeownership, affordable rental housing and company diversity, equity and inclusion.

Consumer Survey Shows 2/3 of Americans Still Financially Unhealthy

The Financial Health Network, Chicago, said even as the financial health of many Americans improved over the past year, a full two-thirds of Americans remain vulnerable in their financial health.

MBA Submits Comments on FHFA Proposed GSE 2022-2024 Housing Goals

The Mortgage Bankers Association on Monday submitted comments to the Federal Housing Finance Agency on its proposed rule for 2022-2024 housing goals for Fannie Mae and Freddie Mac.

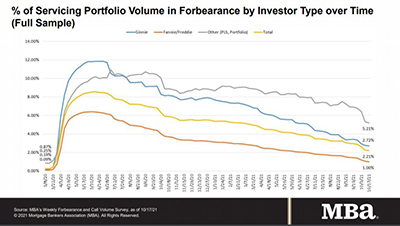

Share of Mortgage Loans in Forbearance Decreases to 2.21%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 7 basis points to 2.21% of servicers’ portfolio volume as of October 17 from 2.28% the week before. MBA estimates 1.1 million homeowners are in forbearance plans.