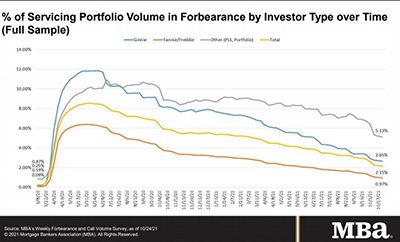

“One million homeowners remained in forbearance as we reached the end of October, but the forbearance share continued to decline, with larger declines for portfolio and PLS loans.”

–Mike Fratantoni, MBA Senior Vice President and Chief Economist.

“One million homeowners remained in forbearance as we reached the end of October, but the forbearance share continued to decline, with larger declines for portfolio and PLS loans.”

–Mike Fratantoni, MBA Senior Vice President and Chief Economist.

The Mortgage Bankers Association’s Servicing Solutions Conference & Expo 2022 takes place Feb. 22-25 at the Hyatt Regency Orlando.

Loans in forbearance fell to a new post-pandemic low, with the share of Fannie Mae/Freddie Mac loans in forbearance falling under 1%, the Mortgage Bankers Association reported Monday.

The Mortgage Bankers Association last week sent a letter to Sen. Charles Grassley, R-Iowa, in support of his amendment to a bill that would make changes to enforcement of the False Claims Act.

The Federal Housing Finance Agency last week issued a notice of proposed rulemaking that would introduce additional public disclosure requirements to the Enterprise Regulatory Capital Framework for Fannie Mae and Freddie Mac.

ATTOM, Irvine, Calif., released its fourth-quarter Vacant Property and Zombie Foreclosure Report, showing 1.3 million residential properties in the United States sit vacant, representing 1.3 percent, or one in 75 homes, in the U.S.

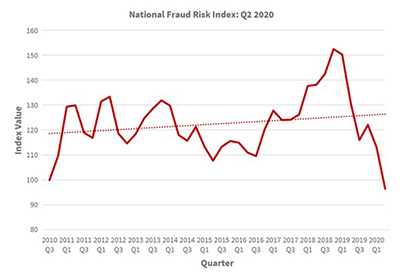

CoreLogic, Irvine, Calif., said its quarterly Mortgage Fraud Report showed a 37.2% year-over-year increase in fraud risk at the end of the second quarter.

The Mortgage Bankers Association sent a letter of support last week To Sen. Tim Scott, R-S.C., who introduced a bill would prevent the Internal Revenue Service and the Treasury Department from imposing unusual reporting requirements on financial services providers to track and submit customer account information.

The Mortgage Bankers Association last week sent a letter to the Federal Housing Finance Agency, offering recommendation to improve Fannie Mae and Freddie Mac’s efforts to address long-standing challenges related to housing equity and the racial homeownership gap.

The Mortgage Bankers Association’s Servicing Solutions Conference & Expo 2022 takes place Feb. 22-25 at the Hyatt Regency Orlando.