The Federal Housing Agency reported Fannie Mae and Freddie Mac sold nearly 131,000 non-performing loans with a total unpaid balance of $24.5 billion through June 30.

Category: News and Trends

MBA Letter Offers Recommendations to FHFA Proposed Regulatory Capital Framework

The Mortgage Bankers Association, in a Nov. 23 letter to the Federal Housing Finance Agency, offered a series of recommendations to improve a proposed regulatory capital framework rule for Fannie Mae and Freddie Mac.

Quote

“Net production profit rebounded in the third quarter of 2021 after a drop-off in the second quarter, but was down more than half from the record profit one year ago.”

–Marina Walsh, CMB, MBA Vice President of Industry Analysis.

CFPB Issues RFI on Detecting Discrimination in Mortgage Lending

The Consumer Financial Protection Bureau on Nov. 16 issued a Request for Information seeking input on rules implementing the Home Mortgage Disclosure Act.

FHFA Releases 2022 Scorecard for GSEs, CSS

The Federal Housing Finance Agency on Wednesday released its 2022 Scorecard for Fannie Mae, Freddie Mac and Common Securitization Solutions LLC.

MBA Servicing Solutions Conference & Expo in Orlando Feb. 22-25

The Mortgage Bankers Association’s Servicing Solutions Conference & Expo 2022 takes place Feb. 22-25 at the Hyatt Regency Orlando.

MBA Offices Closed Nov. 25/26

Mortgage Bankers Association offices will be closed on Thursday, Nov. 25 and Friday, Nov. 26 in observance of the Thanksgiving holidays.

Keeping Current With Midland Loan Services’ David Harrison

MBA Newslink interviewed Midland Loan Services’ Chief Operating Officer, David Harrison who leads the industry’s largest third-party servicing operation

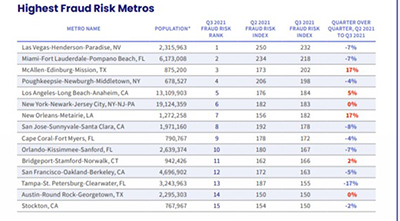

Q3 Fraud Risk Index Falls by 4.6%

CoreLogic, Irvine, Calif., said its National Mortgage Application Fraud Risk Index decreased by 4.6% in the third quarter, from 132 in the second quarter and from 126 a year ago.

To the Point with Bob: Servicers are Helping Borrowers Through the Pandemic

Policymakers have gone to great lengths to provide servicers and borrowers the tools they need to bring about a successful resolution in the vast majority of cases. I hope that policymakers will continue to allow servicers to do what they do best – help their customers.