Six federal agencies issued notice on Tuesday that they will not modify their current definition of a Qualified Residential Mortgage.

Category: News and Trends

MBA: 3Q Holdings of Commercial/Multifamily Mortgage Debt Increase

Commercial/multifamily mortgage debt outstanding increased by $64.8 billion (1.6 percent) in the third quarter, according to the Mortgage Bankers Association’s latest Commercial/Multifamily Mortgage Debt Outstanding report.

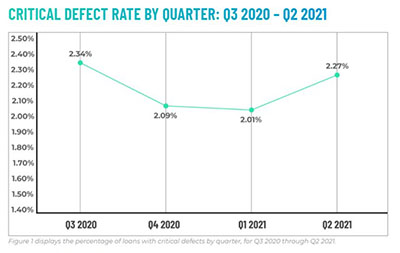

ACES: Q2 Critical Defect Rate Up 13%

ACES Quality Management, Denver, reported a13% increase in overall critical defect rates to 2.27%, ending a multi-quarter trend of improvement.

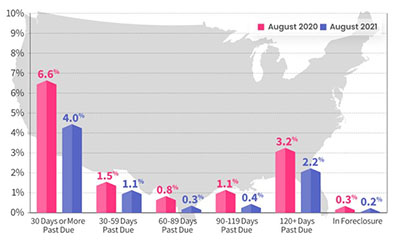

Mortgage Delinquency Declines Approach Pre-Pandemic Levels

As home equity continues to soar, mortgage delinquency rates fell to levels not seen since onset of the coronavirus pandemic, said CoreLogic, Irvine, Calif.

Biden Nominates Sandra Thompson as FHFA Director

President Joe Biden on Tuesday announced his intent to nominate Sandra Thompson as Director of the Federal Housing Finance Agency, an appointment long-supported by the Mortgage Bankers Association.

Quote

“The share of loans in forbearance in November declined – albeit at a slower pace than October – as borrowers continued to near the expiration of their forbearance plans and moved into permanent loan workout solutions.”

–Marina Walsh, CMB, MBA Vice President of Industry Analysis.

Top Five Commercial Mortgage Servicing Issues to Watch in 2022

With 2022 quickly approaching, MBA’s Servicer Council recently hosted a discussion with servicing executives from PGIM Real Estate, SitusAMC, Mount Street, Berkadia and Trimont, who shared perspective on the challenges and opportunities facing the sector.

MBA Servicing Solutions Conference & Expo in Orlando Feb. 22-25

The Mortgage Bankers Association’s Servicing Solutions Conference & Expo 2022 takes place Feb. 22-25 at the Hyatt Regency Orlando.

Top Five Commercial Mortgage Servicing Issues to Watch in 2022

With 2022 quickly approaching, MBA’s Servicer Council recently hosted a discussion with servicing executives from PGIM Real Estate, SitusAMC, Mount Street, Berkadia and Trimont, who shared perspective on the challenges and opportunities facing the sector.

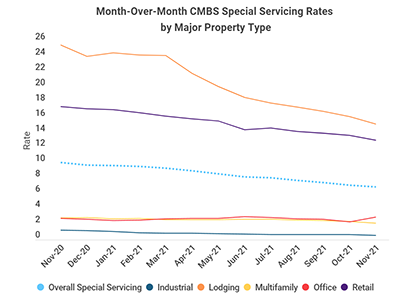

CMBS Delinquency, Special Servicing Rates Fall

Trepp, New York, reported both the commercial mortgage-backed securities delinquency rate and special servicing rate dropped in November.