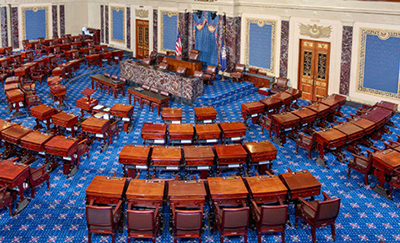

The Mortgage Bankers Association and more than a dozen industry trade groups on Monday urged Senate leadership to support legislation that would address “tough legacy” contracts that currently reference the soon-to-expire London InterBank Offered Rate.

Category: News and Trends

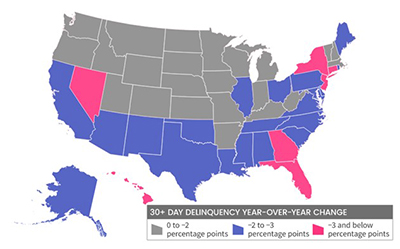

CoreLogic: Delinquencies Fall Below Pre-Pandemic Levels

Ahead of this Thursday’s National Delinquency Survey from the Mortgage Bankers Association, Corelogic, Irvine, Calif., reported November’s loan delinquency rates fell to levels last seen before the coronavirus pandemic.

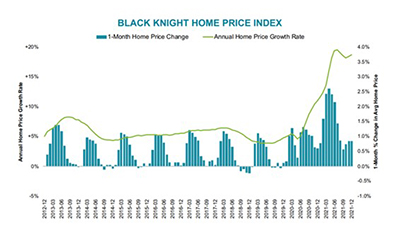

Home Prices Re-accelerate; Equity Smashes Records; ‘Worst Affordability in 14 Years’

Black Knight, Jacksonville, Fla., said inventory shortfalls caused home prices to re-accelerate in 2021, putting pressure on home affordability but also creating for homeowners a record amount of tappable equity.

MBA, Trade Groups Urge Senate Support of ‘Tough Legacy’ LIBOR Bill

The Mortgage Bankers Association and more than a dozen industry trade groups on Monday urged Senate leadership to support legislation that would address “tough legacy” contracts that currently reference the soon-to-expire London InterBank Offered Rate.

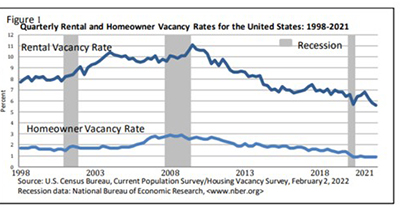

Homeownership Rate Holds Steady; Vacancy Rates Hit 38-Year Low

The nation’s homeownership rate held relatively steady at 65.5 percent in the fourth quarter, the Census Bureau reported last week. But analysts said the rate could be somewhat higher, given the current shortage of homes available for sale.

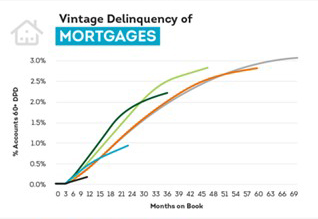

TransUnion: Recent Vintage Loans Perform Well Even as More Non-Prime Consumers Gain Credit

TransUnion, Chicago, said consumer credit performance maintained healthy levels across auto, credit card, personal loans and mortgages in the fourth quarter even as lenders continued to ramp up new account origination growth in the non-prime segment of the market.

Strong Housing Market Boosts Sharp Rise in Homeowner Equity

ATTOM, Irvine, Calif., said mortgage residential properties considered “equity-rich” jumped to nearly 42 percent in the fourth quarter as rising home prices boosted homeowner equity.

Quote

“Income growth has helped to reduce past-due rates and home equity build-up has reduced the likelihood of a distressed sale for families that experience financial challenges.”

–Frank Nothaft, Chief Economist with CoreLogic, Irvine, Calif.

MBA Servicing Solutions Conference & Expo in Orlando Feb. 22-25

The Mortgage Bankers Association’s Servicing Solutions Conference & Expo 2022 takes place Feb. 22-25 at the Hyatt Regency Orlando.

Orest Tomaselli of CondoTek on Condo/Co-op Compliance

Orest Tomaselli is President of the Condominium and Cooperative Review Division of CondoTec, Philadelphia, and owner of Strategic Inspections, a national reserve study provider.