Zillow, Seattle, reported a record 146 U.S. metros became new “million-dollar cities” in 2021, making 481 cities in which the typical home value is at least $1 million.

Category: News and Trends

CREF22: As Issuance Rebounds, Securitization Products Adapt

SAN DIEGO–Commercial mortgage-backed securities are evolving as issuance bounces back, analysts said here at the 2022 MBA Commercial/Multifamily Finance Convention and Expo.

MISMO Seeks Comment on Reporting Guide to Facilitate Exchange of Forbearance Data

MISMO®, the real estate finance industry standards organization, seeks public comment on a new guide and sample credit response designed to help industry professionals using MISMO Reference Models v3.4 and v3.5 better report on loans that have been in or are in forbearance.

MBA Submits Comments to OCC on Draft Principles for Climate-Related Financial Risk Management

The Mortgage Bankers Association last week submitted comments to the Office of the Comptroller of the Currency on its draft principles for climate-related financial risk management for large banks.

Quote

“Figure out what your company is doing on ESG. Because you don’t want to be at an investor meeting and have a ‘deer in the headlights’ moment when people ask you what you are doing on ESG.”

–Lisa Brylowski, Global ESG Coordinator and Vice President with Brookfield Asset Management, Toronto.

MBA: 2022 Commercial/Multifamily Mortgage Maturity Volumes to Increase 12 Percent

SAN DIEGO — The Mortgage Bankers Association said $248.8 billion of the $2.6 trillion (12 percent) of outstanding commercial and multifamily mortgages held by non-bank lenders and investors will mature in 2022, a 12 percent increase from the $222.5 billion that matured in 2021.

Wells Fargo Leads MBA 2021 Year-End Commercial/Multifamily Servicer Rankings

SAN DIEGO — The Mortgage Bankers Association released its year-end ranking of commercial and multifamily mortgage servicers’ volumes as of December 31.

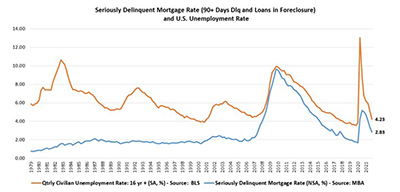

Mortgage Delinquencies Near Pre-Pandemic Lows

Delinquency rates for mortgage loans on one-to-four-unit residential properties continued to trend downward, nearing historic lows last seen before the coronavirus pandemic, the Mortgage Bankers Association reported Thursday.

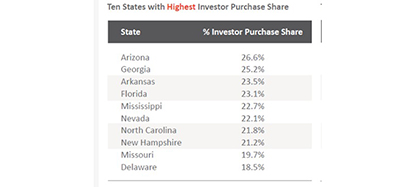

Real Estate Investor Purchases Up 40% From Year Ago

Real estate investor purchases accounted for 16.4% of all home purchases nationally in the third quarter from 11.7% a year ago, an increase of more than 40 percent, reported RealtyTrac, Irvine, Calif.

FHFA Seeks Input on FY2022-2026 Strategic Plan

The Federal Housing Finance Agency on Wednesday asked for input on its Draft Strategic Plan, which outlines the Agency’s priorities for the coming years as regulator of the Federal Home Loan Bank System and as regulator and conservator of Fannie Mae and Freddie Mac.