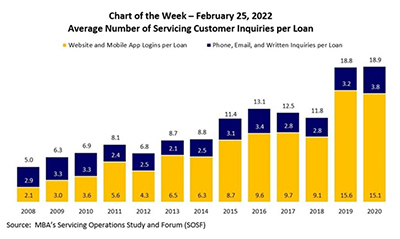

In this week’s MBA Chart of the Week, we focus on borrower communications, specifically the average number of annual servicing customer inquiries per loan. MBA has tracked this data through its Servicing Operations Study and Forum since 2008.

Category: News and Trends

Servicing22: How the Pandemic Made Government Loan Programs More Nimble

ORLANDO—Perhaps the most innovative adaption in the real estate finance industry during the coronavirus pandemic came not from the mortgage industry itself, but from the historically least agile sector—government loan programs.

Sponsored Content from ACES Quality Management: Prep Your Audit Process for Fair Servicing

Given regulators’ renewed focus on fair lending and fair servicing, learn how to enhance your audit practices to meet regulatory expectations in 2022 and beyond.

1Q ‘Zombie’ Properties Edge Down Despite Uptick in Foreclosure Activity

ATTOM, Irvine, Calif., reported a drop in vacant “zombie” properties in the first quarter despite an increase in foreclosure activity for the second straight quarter.

Servicing22: ‘The Most Essential Work in Mortgage Finance’

ORLANDO—The Mortgage Bankers Association’s Servicing Solutions Conference & Expo is live and in person for the first time since 2020. MBA Chair Kristy Fercho opened the Conference by acknowledging the challenging environment servicers have faced during that period.

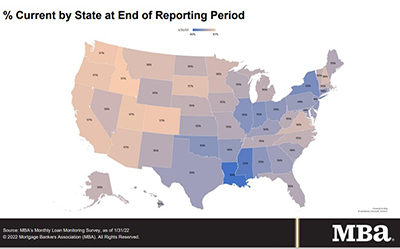

MBA: Share of Mortgage Loans in Forbearance Drops to 1.30%

Loans in forbearance fell again in January to pre-pandemic lows, the Mortgage Bankers Association reported on Monday.

Quote

“Figure out what your company is doing on ESG. Because you don’t want to be at an investor meeting and have a ‘deer in the headlights’ moment when people ask you what you are doing on ESG.”

–Lisa Brylowski, Global ESG Coordinator and Vice President with Brookfield Asset Management, Toronto.

MISMO Seeks Comment on Reporting Guide to Facilitate Exchange of Forbearance Data

MISMO®, the real estate finance industry standards organization, seeks public comment on a new guide and sample credit response designed to help industry professionals using MISMO Reference Models v3.4 and v3.5 better report on loans that have been in or are in forbearance.

CREF22: ESG, CRE and Green Lending

SAN DIEGO — As climate change intensifies, investors, owners and lenders increasingly demand environmental, social and governance reporting, panelists said here at the Mortgage Bankers Association’s 2022 Commercial/Multifamily Finance Convention and Expo.

CoreLogic: 1 in 10 U.S. Residential Properties Affected by Natural Disasters in 2021

CoreLogic, Irvine, Calif., said nearly 14.5 million single-family and multifamily homes—nearly 10 percent of all U.S. residential properties—were directly affected by natural disaster events in 2021.