MISMO®, the real estate finance industry standards organization, seeks participants for an initiative focused on standardizing disclosure of flood risks. Separately, MISMO seeks public comment on a proposed Adverse Action Notice Dataset.

Category: News and Trends

MBA: CMF Mortgage Debt Outstanding Reaches New High

Commercial/multifamily mortgage debt outstanding at year-end 2021 rose by $287 billion (7.4 percent) from the previous year, the Mortgage Bankers Association reported Wednesday.

MBA: IMB 4Q Production Profits Fall to 3-Year Low

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net gain of $1,099 on each loan they originated in the fourth quarter, its lowest level in three years, the Mortgage Bankers Association reported last Tuesday.

Quote

“With revenue tightening and volume slowing, it is becoming increasingly important for companies to adjust costs as the lending landscape moves from a rate-term refinancing market to a purchase and cash-out refinancing market.”

–MBA Vice President of Industry Analysis Marina Walsh, CMB.

CREF Policy Update: SEC Issues Notice of Proposed Rulemaking on Climate Risks

The Securities and Exchange Commission on Monday voted 3-1 to release a Notice of Proposed Rulemaking that includes amendments requiring a domestic or foreign registrant to include certain climate-related information in its registration statements and periodic reports.

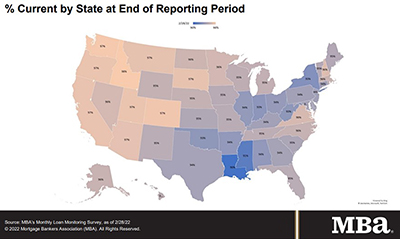

MBA: Share of Mortgage Loans in Forbearance Drops to 1.18%

The Mortgage Bankers Association’s monthly Loan Monitoring Survey reported loans now in forbearance decreased by 12 basis points to 1.18% of servicers’ portfolio volume as of Feb. 28 from 1.30% in January. MBA estimates 590,000 homeowners are in forbearance plans.

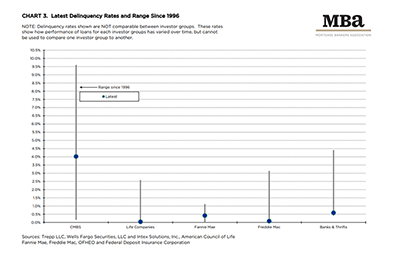

MBA: 4Q Commercial, Multifamily Mortgage Delinquency Rates Decline

Commercial and multifamily mortgage delinquencies declined in the fourth quarter, the Mortgage Bankers Association reported Monday in its Commercial/Multifamily Delinquency Report.

DBRS: Hotel Pandemic Distress Less Than Prior Downturns

COVID-19 hit the hotel sector hard. DBRS Morningstar, Toronto, reported hotels had the highest loan modification rate among major property sectors due to the pandemic but said liquidations were lower than prior downturns.

Senate Banking Committee Moves Thompson Nomination to Head FHFA

The Senate Banking Committee on Wednesday approved Sandra Thompson’s nomination to serve as Director of the Federal Housing Finance Agency. The Mortgage Bankers Association issued a statement commending the vote.

Tom Lamalfa: 1Q22 Industry Update

The steep run-up in interest rates, especially mortgage rates, since the start of the year prompted the mini survey I conducted in early March. It consisted of 10 questions that were put to 17 senior mortgage banking experts.