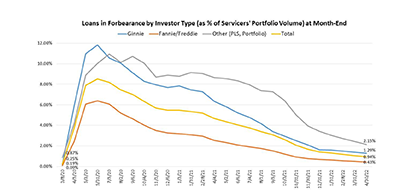

Loans in forbearance fell below 1%, the Mortgage Bankers Association reported Monday.

Category: News and Trends

#MBACREFST22: Servicers Survive A Crisis for the Ages

LOS ANGELES–Commercial mortgage servicers have faced–and weathered–a “crisis for the ages,” said Mortgage Bankers Association Chair-Elect Matt Rocco here Monday at the MBA Commercial/Multifamily Finance Servicing and Technology Conference.

#MBASecondary22: CFPB’s Chopra Looks to Technology—and Takes Aim at Mortgage Servicing

NEW YORK—Consumer Financial Protection Bureau Director Rohit Chopra says the future of consumer finance—and financial regulation—lies in technology.

#MBASecondary22: ‘The Time for Leadership’

NEW YORK—Mortgage Bankers Association President & CEO Bob Broeksmit, CMB, opened the MBA Secondary and Capital Markets Conference here on Monday in a very different mortgage environment from its most recent gathering three years ago.

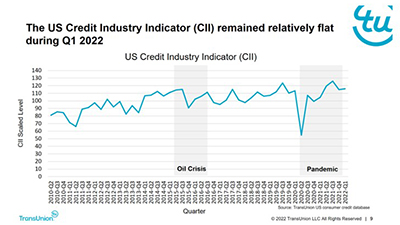

Despite Challenges, 1Q Consumer Credit Health Stays Strong

Rising interest rates and increased prices of goods and services placed pressure on the consumer wallet in the first quarter. Despite the challenges, consumers remain well positioned from a consumer credit perspective, according to the Quarterly Credit Industry Insights Report from TransUnion, Chicago.

Majority of Real Estate Investors Describe Local Markets as ‘Overvalued’

Auction.com, Irvine, Calif., said 55 percent of buyers purchasing distressed properties on Auction.com described their local market as “overvalued” with a correction possible, up from 40 percent a year ago.

Senate Confirms Julia Gordon as FHA Commissioner

It took nearly a year, and by the slimmest of margins, the Senate late Wednesday finally confirmed Julia Gordon, as FHA Commissioner.

Millennials’ Late Homeownership, Increased Migration Impact Insurance Carriers

Seemingly little things can have big consequences. For the insurance industry, said TransUnion, Chicago, the delay in Millennial homeownership has had ripple effects that insurance providers are feeling now.

Nearly Half of U.S. Homeowners Equity-Rich

ATTOM, Irvine, Calif., reported 44.9 percent of mortgaged residential properties in the United States were considered equity-rich in the first quarter, up by more than 15 percent from just a year ago.

ATTOM: April Foreclosures Down 8% Monthly, Up from Year Ago

ATTOM, Irvine, Calif., reported properties with foreclosure filings in April fell by 8 percent from March but jumped by 160 percent from a year ago. Completed foreclosures, meanwhile, fell by 36 percent from March.