NEW YORK—With fraud, data hacks and ransomware on the rise, cyber crime is a more visible threat to financial services companies.

Category: News and Trends

MBA, Winnow Solutions LLC Partner to Help Members with Compliance Research, Costs

The Mortgage Bankers Association and Winnow Solutions LLC, Anaheim, Calif., announced a partnership that will provide MBA member subscribers – at a 10% discount rate – a comprehensive database of state and federal regulations to help control costs and better manage the growing complexity of mortgage regulations.

MISMO Issues MI Version 3.4 Implementation Guide for Electronic Ordering of MI Requests, Commitments

MISMO®, the real estate finance industry standards organization, launched an updated Mortgage Insurance Version 3.4 Implementation Guide.

Quote

“A stunning five million families are still in their homes, thanks in large to your grace and good work. It’s tough to overstate the difference you made. We’ve heard a lot of talk about ‘stimulus’ and ‘relief,’ but you did more than anyone else to make those words a reality. When interest rates fell, you helped borrowers turn them into refis. And when checks went out, you helped families turn them into the down payment on a new home.”

–MBA President & CEO Bob Broeksmit, CMB.

Quote

“With the record-setting refinance volume of the past two years in the rearview mirror, the mortgage industry is clearly in a period of transition and many companies will need to make tough decisions.”

–Marina Walsh, CMB, MBA Vice President of Industry Analysis.

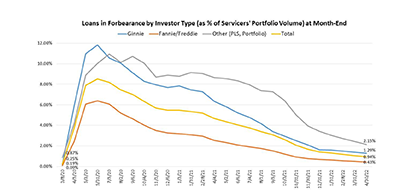

Share of Mortgage Loans in Forbearance Falls Under 1%

Loans in forbearance fell below 1%, the Mortgage Bankers Association reported Monday.

#MBACREFST22: Servicers Survive A Crisis for the Ages

LOS ANGELES–Commercial mortgage servicers have faced–and weathered–a “crisis for the ages,” said Mortgage Bankers Association Chair-Elect Matt Rocco here Monday at the MBA Commercial/Multifamily Finance Servicing and Technology Conference.

#MBASecondary22: CFPB’s Chopra Looks to Technology—and Takes Aim at Mortgage Servicing

NEW YORK—Consumer Financial Protection Bureau Director Rohit Chopra says the future of consumer finance—and financial regulation—lies in technology.

#MBASecondary22: ‘The Time for Leadership’

NEW YORK—Mortgage Bankers Association President & CEO Bob Broeksmit, CMB, opened the MBA Secondary and Capital Markets Conference here on Monday in a very different mortgage environment from its most recent gathering three years ago.

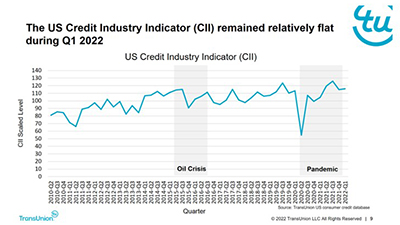

Despite Challenges, 1Q Consumer Credit Health Stays Strong

Rising interest rates and increased prices of goods and services placed pressure on the consumer wallet in the first quarter. Despite the challenges, consumers remain well positioned from a consumer credit perspective, according to the Quarterly Credit Industry Insights Report from TransUnion, Chicago.