MISMO®, the real estate finance industry standards organization, launched a new guide and sample credit response to help industry professionals using MISMO Reference Models v3.4 and v3.5 better report on loans that have been in or are in forbearance.

Category: News and Trends

Analysis: 1/3 of Declined Mortgage Applications Addressable with Homebuyer Assistance

Down Payment Resource, Atlanta, said its analysis of mortgage loan applications found nearly one-third of declined mortgage loan applications are both declined for reasons that can be addressed with homebuyer assistance and eligible for homebuyer assistance programs.

2nd Home Hotspots See Outsized Growth in Rental, Home Prices

As remote work prompted many Americans to relocate during the pandemic, housing costs soared in second-home hotspots even more than the rest of the country, according to Redfin, Seattle.

FHFA, GSEs Detail Equitable Housing Finance Plans

The Federal Housing Finance Agency on Wednesday offered details of the government-sponsored enterprises’ Equitable Housing Finance Plans for 2022-2024.

Quote

“The GSEs’ plans – focused on a typical consumer’s housing lifecycle – should allow for increased opportunities for minority households to secure affordable rental housing, prepare for homeownership and obtain access to safe and affordable mortgage credit. While the plans are targeted to Black and Hispanic borrowers, all low- and moderate-income borrowers and communities should benefit.”

–MBA President & CEO Robert Broeksmit, CMB.

FHFA Releases GSE 2021 Mission Report

The Federal Housing Finance Agency released its annual Mission Report that describes Fannie Mae, Freddie Mac and Federal Home Loan Bank activities to increase access to financing for economic development and affordable, equitable and sustainable housing.

Redfin: Homes with High Fire Risk Sell for More as Americans Flock to Fire-Prone Areas

Redfin, Seattle, said its analysis of homes for sale in high fire-risk areas found the median sale price of U.S. homes with high fire risk was $550,500 in April, compared with $431,300 for homes with low fire risk—a difference of nearly $120,000.

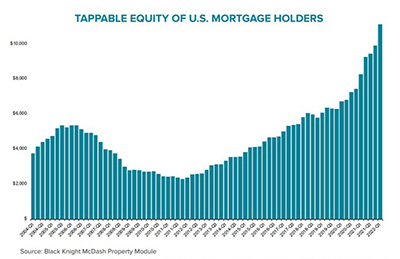

Mortgage Holders Gain $1.2 Trillion in 1Q Tappable Equity

The least-affordable housing market in nearly two decades provides at least one windfall—the average home has gained nearly 9 percent in value since just the start of 2022, with homeowners gaining more than $1.2 trillion in equity in the first quarter, said Black Knight, Jacksonville, Fla.

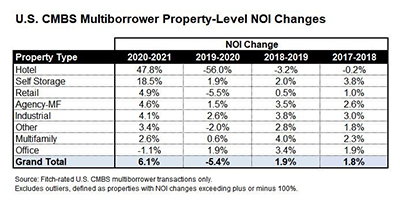

Fitch: CMBS Properties See NOI Recovery

Fitch Ratings, New York, reported property-level net operating income for commercial mortgage-backed securities loans rebounded 6.1 percent on average in 2021.

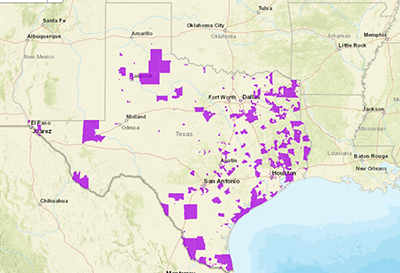

Home Values in ‘Opportunity Zones’ Keep Pace with National Gains

Home values in federal and state Opportunity Zone Redevelopment Areas—the controversial zones created in 2017 to spur economic development—are keeping up with nationwide home values, reported ATTOM, Irvine, Calif.