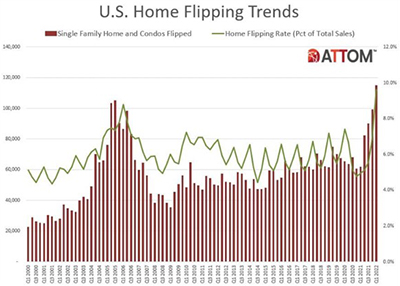

ATTOM, Irvine, Calif., reported a sharp increase in home flipping in the first quarter—but profits did not necessarily follow suit.

Category: News and Trends

CoreLogic: 7.8 Million U.S. Properties at Risk of Hurricane-Force Wind, Storm Surge Damage

CoreLogic, Irvine, Calif., said its risk modeling shows nearly 7.8 million homes with more than $2.3 trillion in combined reconstruction cost value are at risk of hurricane-related damages.

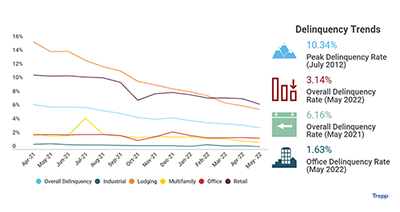

CMBS Delinquency Rate Falls Sharply

Trepp LLC, New York, said the commercial mortgage-backed securities delinquency rate posted another large decline in May.

FHFA Re-Assures MBA, Trades’ Concerns over New GSE Credit Score Requirements

Following concerns expressed in a May 13 letter, the Federal Housing Finance Agency assured the Mortgage Bankers Association and other industry trade groups that industry stakeholders such as themselves would have sufficient time to implement necessary system and process changes that any updates to Fannie Mae and Freddie Mac’s credit score requirements would entail.

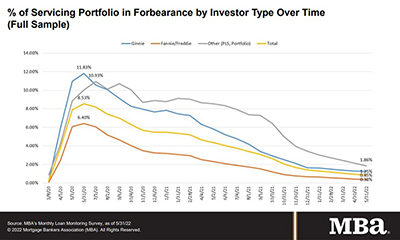

Share of Mortgage Loans in Forbearance Falls to 0.85%

Mortgage loans in forbearance fell to new post-pandemic lows in May, the Mortgage Bankers Association reported.

Quote

“Servicers are whittling away at the remaining loans in forbearance, even as the pace of monthly forbearance exits slowed in May to a new survey low. Most borrowers exiting forbearance are moving into either a loan modification, payment deferral or a combination of the two workout options.”

–Marina Walsh, CMB, MBA Vice President of Industry Analysis.

MBA, NFHA Launch Online Toolkit for Special Purpose Credit Programs in Underserved Communities

The Mortgage Bankers Association and National Fair Housing Alliance announced a new online toolkit for mortgage lenders interested in developing Special Purpose Credit Programs, which permit lenders to offer mortgage credit to economically and socially disadvantaged borrowers and are an important tool for ensuring financial institutions can meet the needs of their consumers.

MBA Selects Philadelphia as its Third CONVERGENCE City

The Mortgage Bankers Association selected Philadelphia as the site for its next CONVERGENCE initiative, a place-based partnership focused on narrowing the racial homeownership gap. CONVERGENCE Philadelphia will launch in early 2023, joining CONVERGENCE initiatives in Memphis, Tenn., and Columbus, Ohio.

MBA, NFHA Launch Online Toolkit for Special Purpose Credit Programs in Underserved Communities

The Mortgage Bankers Association and National Fair Housing Alliance announced a new online toolkit for mortgage lenders interested in developing Special Purpose Credit Programs, which permit lenders to offer mortgage credit to economically and socially disadvantaged borrowers and are an important tool for ensuring financial institutions can meet the needs of their consumers.

MBA Letter Offers SEC Recommendations on Climate-Related Risk, Greenhouse Gas Emissions

The Mortgage Bankers Association on Friday submitted a letter to the Securities and Exchange Commission on its notice of proposed rulemaking on new mandatory disclosures related to climate-related risk and company greenhouse gas emissions.