As we emerge from two years of the pandemic, a new reality is clear: it is getting easier to conduct digital closings, thanks to improving technology and an increased awareness of the possibilities.

Category: News and Trends

MBA’s Bob Broeksmit, CMB, on How to Narrow Minority Homeownership Gap

Mortgage Bankers Association President and CEO Robert Broeksmit, CMB, said Special Purpose Credit Programs can provide lenders with an effective way to serve minority groups who do not have access to generational wealth.

Carolyn Thomas of KHA Alpine Advisors: Business Volumes Demand Efficient Solutions to Your Accounting and Compliance Needs

With a shift in the mortgage industry, the demand for outsourcing continues to grow, especially in the professional services sector.

Anita Bush of FICS: Mortgage Servicers Must Improve Support for Borrowers with Limited English Skills

Mortgage servicers must provide language resources for borrowers with limited English proficiency. The 2020 Census confirmed what mortgage professionals have experienced over the past decade – America’s diversity increases every year with minority homeownership growing rapidly.

Multifamily Rent Growth Still Climbing

The momentum surrounding multi-housing rent growth has continued in 2022 and currently outpaces inflationary growth, reported JLL Capital Markets, Chicago.

Fitch Ratings: Title Insurers Brace for Macroeconomic Pressures

U.S. title insurance companies’ statutory capital should remain very strong even as macroeconomic pressures mount in the coming months, Fitch Ratings said in a new report

Quote

“Saving for a down payment is one of the biggest hurdles first-time buyers face. Special Purpose Credit Programs can provide lenders with an effective way to serve minority groups who do not have access to generational wealth to use as part of their down payment.”

–Mortgage Bankers Association President and CEO Robert Broeksmit, CMB.

Broeksmit Weighs in on How to Narrow Minority Homeownership Gap

Mortgage Bankers Association President and CEO Robert Broeksmit, CMB, said Special Purpose Credit Programs can provide lenders with an effective way to serve minority groups who do not have access to generational wealth.

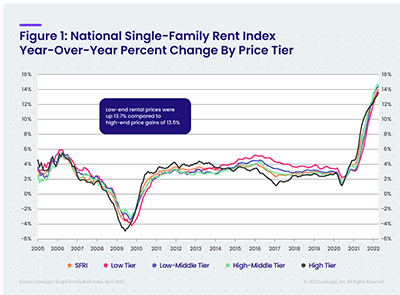

Single-Family Rent Growth Sees 13th Consecutive Record-Breaking Month

CoreLogic, Irvine, Calif., said U.S. single-family rent growth continued its hot streak in April, with prices up by 14 percent year-over-year for the thirteenth consecutive month of record-breaking annual gains.

Homebuyers on $2,500 Monthly Budget Lose $118,000 in Spending Power in 2022

Redfin, Seattle, said a homebuyer on a $2,500 monthly budget has lost nearly $120,000 in spending power since the end of last year as mortgage rates have nearly doubled.