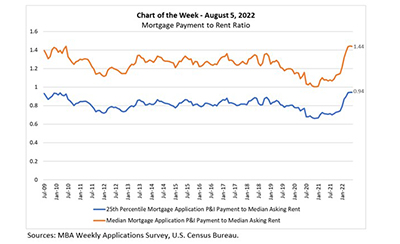

This MBA Chart of the Week examines the relationship between mortgage payments and asking rents since the second half of 2009. MBA’s national mortgage payment to rent ratio compares the national median and 25th percentile mortgage payments to the national median asking rent.

Category: News and Trends

Senate Passes $740B Reconciliation Package; Drops MBA-Opposed Carried Interest Provision

After hours of procedural debate on Saturday afternoon, followed by a marathon overnight “vote-a-rama” (a series of amendment votes – none of which pertained directly to real estate finance), the Senate on Sunday passed an amendment in the nature of a substitute to H.R. 5376, now known as the Inflation Reduction Act, by a 51-50 vote (Vice President Kamala Harris breaking the tie).

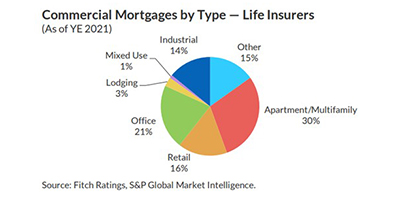

Fitch Ratings: U.S. Life Insurers’ Commercial Mortgages Stable Amid Growing Headwinds

Fitch Ratings, New York, said U.S. life insurers’ commercial mortgage fundamentals have largely recovered since the pandemic, with stable property outlooks for hotel, office retail and multifamily sectors.

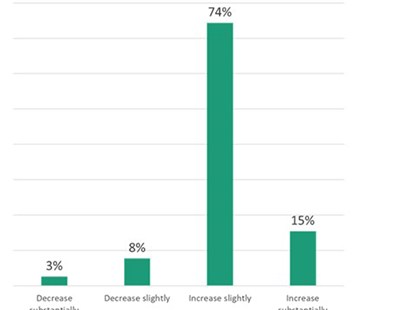

Survey: 90% Mortgage Servicers Expect Foreclosures to Increase through Next Year

Auction.com, Irvine, Calif., said its annual Seller Insights Report found nine in 10 mortgage servicers disposing of distressed properties on the Auction.com platform expect their foreclosure auction volume to increase in the next 12 months.

More Homebuyers Flock to Climate Risky Areas, Despite Intensifying Natural Disasters

Wildfires? Floods? Other natural disasters? “Bring it on,” homeowners seem to be saying.

2Q Homeowner Equity Spikes; Tappable Equity Again at Record High

Reports from ATTOM, Irvine, Calif., and Black Knight, Jacksonville, Fla., confirm the importance of home equity in a tightening mortgage market.

Quote

“MBA supports a regulatory framework that will provide greater clarity and consistency in the CRA’s application, address changes in the banking industry (including the expanded role of mobile and online banking) and create a consistent regulatory approach that applies to banks regulated by all three Agencies.”

–From an MBA letter to federal regulatory agencies on proposed changes to the Community Reinvestment Act.

MBA Risk Management, QA and Fraud Prevention Forum in Nashville Sept. 11-13

The Mortgage Bankers Association’s annual Risk Management, QA and Fraud Prevention Forum takes place Sept. 11-13 at the Grand Hyatt Nashville.

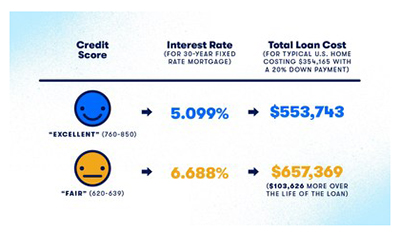

Zillow: Lower Credit Score Homebuyers Pay $104,000 More in Mortgage Costs

Elevated home prices and rising interest rates are feeding into housing affordability woes for potential buyers–especially those with lower credit scores–reported Zillow, Seattle.

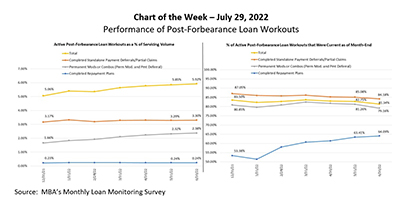

MBA Chart of the Week: Performance of Post-Forbearance Loan Workouts

According to MBA’s Monthly Loan Monitoring Survey, the share of loans in forbearance dropped slightly to 0.81 percent of servicers’ portfolio volume as of June 30, from 0.85 percent the prior month. Only about 404,000 homeowners are still in forbearance plans, after reaching a peak of nearly 4.3 million homeowners in May 2020.