The Federal Housing Finance Agency on Wednesday announced Fannie Mae and Freddie Mac will require servicers to obtain and maintain fair lending data on their loans, and for this data to transfer with servicing throughout the mortgage term.

Category: News and Trends

Ginnie Mae Outlines Plan to Fight Housing Costs, Boost Housing Supply

Ginnie Mae on Wednesday said it will take on a larger role in HUD’s efforts to fight rising housing costs and boost housing supply, releasing a Fact Sheet outlining its efforts to drive liquidity toward equitable and affordable housing.

Reports Show Drops in Delinquencies, Foreclosures

Reports from CoreLogic, Irvine, Calif., and ATTOM, Irvine, show declines in both mortgage delinquencies and foreclosure activity.

Quote

“Foreclosure inventory levels and foreclosure starts remain well below historical averages for the survey – a strong indication that servicers are able to help delinquent borrowers find alternatives to foreclosure. Such alternatives include curing, loan workouts, home sales – with possible equity to spare, or cash-for-keys and deed-in-lieu options.”

–Marina Walsh, CMB, MBA Vice President of Industry Analytics

MBA Risk Management, QA and Fraud Prevention Forum in Nashville Sept. 11-13

The Mortgage Bankers Association’s annual Risk Management, QA and Fraud Prevention Forum takes place Sept. 11-13 at the Grand Hyatt Nashville.

MBA Letter to Agencies Targets Topline CRA Issues

The Mortgage Bankers Association last week sent a letter to federal regulatory agencies, discussing several topline issues it says are crucial to improving the current Community Reinvestment Act framework.

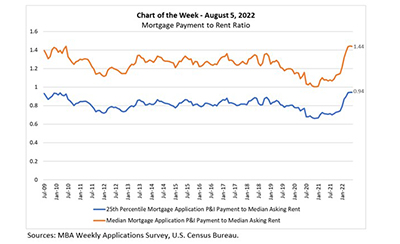

MBA Chart of the Week Aug. 8, 2022: Mortgage Payment to Rent Ratio

This MBA Chart of the Week examines the relationship between mortgage payments and asking rents since the second half of 2009. MBA’s national mortgage payment to rent ratio compares the national median and 25th percentile mortgage payments to the national median asking rent.

Senate Passes $740B Reconciliation Package; Drops MBA-Opposed Carried Interest Provision

After hours of procedural debate on Saturday afternoon, followed by a marathon overnight “vote-a-rama” (a series of amendment votes – none of which pertained directly to real estate finance), the Senate on Sunday passed an amendment in the nature of a substitute to H.R. 5376, now known as the Inflation Reduction Act, by a 51-50 vote (Vice President Kamala Harris breaking the tie).

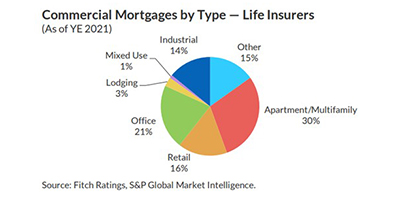

Fitch Ratings: U.S. Life Insurers’ Commercial Mortgages Stable Amid Growing Headwinds

Fitch Ratings, New York, said U.S. life insurers’ commercial mortgage fundamentals have largely recovered since the pandemic, with stable property outlooks for hotel, office retail and multifamily sectors.

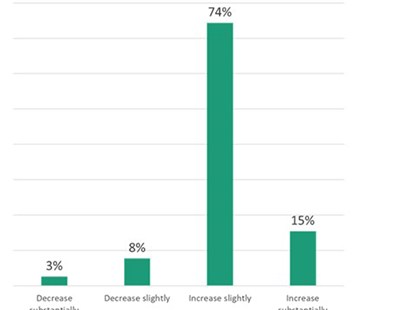

Survey: 90% Mortgage Servicers Expect Foreclosures to Increase through Next Year

Auction.com, Irvine, Calif., said its annual Seller Insights Report found nine in 10 mortgage servicers disposing of distressed properties on the Auction.com platform expect their foreclosure auction volume to increase in the next 12 months.