The Federal Housing Finance Agency and Ginnie Mae on Wednesday updated minimum financial eligibility requirements for seller/servicers and issuers.

Category: News and Trends

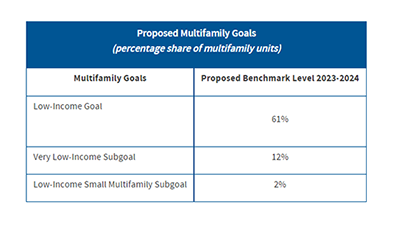

FHFA Proposes 2023-2024 Fannie Mae, Freddie Mac Multifamily Housing Goals

The Federal Housing Finance Agency on Tuesday proposed new benchmark levels for Fannie Mae and Freddie Mac multifamily housing goals in 2023 and 2024.

MBA Risk Management, QA and Fraud Prevention Forum in Nashville Sept. 11-13

The Mortgage Bankers Association’s annual Risk Management, QA and Fraud Prevention Forum takes place Sept. 11-13 at the Grand Hyatt Nashville.

Quote

“Foreclosure inventory levels and foreclosure starts remain well below historical averages for the survey – a strong indication that servicers are able to help delinquent borrowers find alternatives to foreclosure. Such alternatives include curing, loan workouts, home sales – with possible equity to spare, or cash-for-keys and deed-in-lieu options.”

–Marina Walsh, CMB, MBA Vice President of Industry Analytics

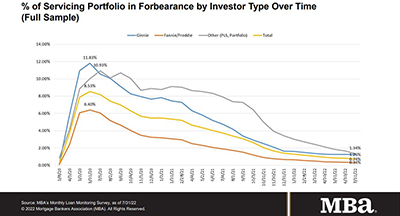

July Mortgage Loan Forbearance Rate Falls to 0.74%

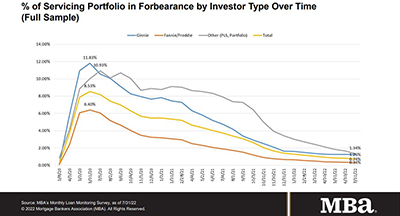

The Mortgage Bankers Association’s monthly Loan Monitoring Survey reported loans in forbearance decreased by 7 basis points to 0.74% of servicers’ portfolio volume as of July 31, from 0.81% in June. MBA estimates 370,000 homeowners remain in forbearance plans.

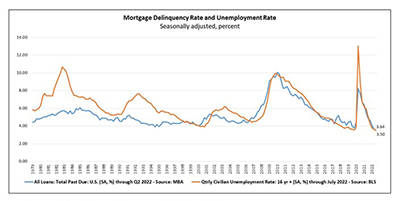

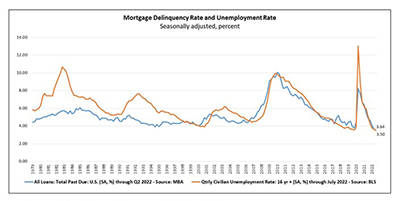

MBA: 2Q Mortgage Delinquency Rate at Record Low

The second quarter mortgage delinquency rate fell to a record low—even beating out pre-pandemic lows—the Mortgage Bankers Association reported Thursday.

Chris Sabbe of PHH Mortgage on the Subservicing Industry

Chris Sabbe is Senior Vice President of Enterprise Sales for PHH Mortgage. A recognized leader in the subservicing industry, he is responsible for managing and growing the company’s enterprise sales and actively onboarding new MSR/Co-Issue sellers. He can be reached at Christopher.Sabbe@mortgagefamily.com.

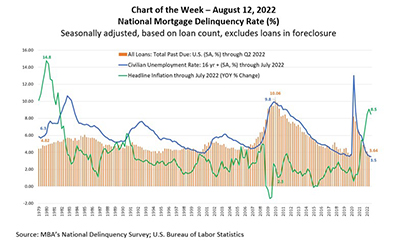

MBA Chart of the Week, Aug. 12, 2022: National Mortgage Delinquency Rate

This week’s MBA Chart of the Week highlights the relationship between MBA’s mortgage delinquency rate and two economic indicators, the unemployment rate, and year-over-year changes in headline inflation – measuring the price of goods and services in the economy.

July Mortgage Loan Forbearance Rate Falls to 0.74%

The Mortgage Bankers Association’s monthly Loan Monitoring Survey reported loans in forbearance decreased by 7 basis points to 0.74% of servicers’ portfolio volume as of July 31, from 0.81% in June. MBA estimates 370,000 homeowners remain in forbearance plans.

MBA: 2Q Mortgage Delinquency Rate at Record Low

The second quarter mortgage delinquency rate fell to a record low—even beating out pre-pandemic lows—the Mortgage Bankers Association reported Thursday.