S&P Global Market Intelligence, New York, reported U.S. public pension funds are increasing their allocations to real estate as a hedge against volatile market conditions.

Category: News and Trends

Quote

“We have long supported the responsible expansion of FHLB membership eligibility to better reflect the diverse providers of single-family and multifamily housing finance throughout the country. The Banks’ membership framework has only seen piecemeal updates since its creation, and there’s a need for an FHLB system that better reflects today’s housing finance market — not one from the 1930s.”

–MBA President & CEO Bob Broeksmit, CMB.

MISMO Releases Bids Wanted in Competition (BWIC) Template for Public Comment

MISMO®, the real estate finance industry standards organization, seeks public comment on a standardized template to facilitate the bidding process for mortgage-backed securities between mortgage originators and dealers for Bids Wanted in Competition (BWIC).

MBA Risk Management, QA and Fraud Prevention Forum in Nashville Sept. 11-13

The Mortgage Bankers Association’s annual Risk Management, QA and Fraud Prevention Forum takes place Sept. 11-13 at the Grand Hyatt Nashville.

MISMO Fall Summit: Ginnie Mae Puts Foot on Gas Pedal

WASHINGTON, D.C.—Ginnie Mae President Alanna McCargo will be the first to tell you that “speed” and “innovation” rarely appear in the same sentence with “federal agencies.” But she’d also be the first to tell you that it is possible.

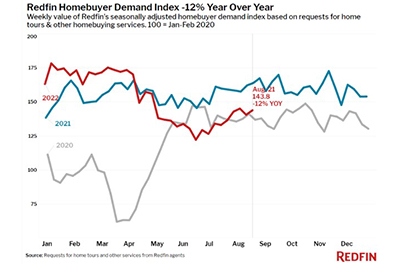

Sellers Increasingly Reluctant to List Homes; Investors Stepping Up

Redfin, Seattle, said would-be sellers are reluctant to list their homes as they have begun to see prices come down. With few new listings, buyers’ newfound bargaining power is reaching its limit, especially now that demand has stabilized.

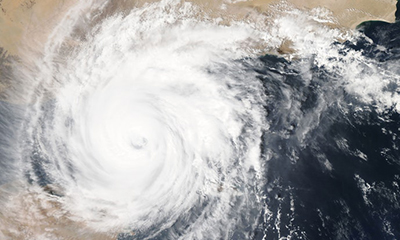

CoreLogic: 30 Years After Hurricane Andrew, Problems Persist for Insurance, Mortgage Industries

CoreLogic, Irvine, Calif., said in the 30 years since Hurricane Andrew devastated much of South Florida, the risk management landscape has evolved “tremendously.” But many questions remain—and with South Florida still a popular place to live, many of the risks from 1992 still exist today.

MISMO Releases Bids Wanted in Competition (BWIC) Template for Public Comment

MISMO®, the real estate finance industry standards organization, seeks public comment on a standardized template to facilitate the bidding process for mortgage-backed securities between mortgage originators and dealers for Bids Wanted in Competition (BWIC).

Black Knight: Foreclosure Starts Pull Back; Delinquencies Edge Higher

Black Knight, Jacksonville, Fla., said foreclosure starts fell in July and remain well below pre-pandemic levels, while early-stage delinquencies edged up.

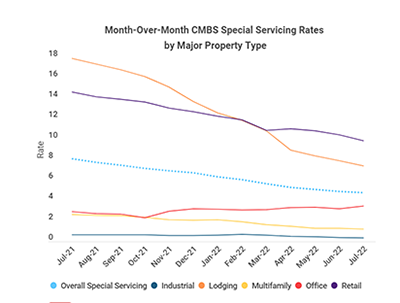

CMBS Special Servicing, Delinquency Rates Dip

Commercial mortgage-backed securities special servicing and delinquency rates both dipped in July, according to Trepp LLC and Fitch Ratings.