NASHVILLE, TENN.—The housing market today is nothing like 2008, said Christa Lynn Greco, IA with the Criminal Investigative Division of the Federal Bureau of Investigation, Washington, D.C. But she said changing market conditions make the potential for mortgage fraud ever-present.

Category: News and Trends

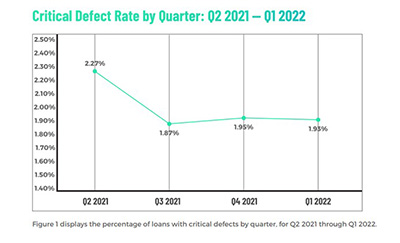

Critical Defect Rate Falls for 2nd Straight Quarter

ACES Quality Management, Denver, said the overall critical defect rate declined for the second straight quarter despite a more challenging mortgage lending environment.

MBA White Paper: Office Market ‘Likely Changed Forever’

The ongoing tug of war between employers and employees about returning to the office will accelerate as pandemic-related impacts fade, according to a new Mortgage Bankers Association white paper.

MBA Regulatory Compliance Conference in D.C. Sept. 18-20

The Mortgage Bankers Association’s annual Regulatory Compliance Conference takes place Sept. 18-20 at the Grand Hyatt in Washington, D.C.

Quote

“Everyone has a role in risk management. Revenue is not as important as having sound practices in place.”

—-Cheryl Feltgen, Executive Vice President and Chief Risk Officer with Arch Mortgage Insurance Co., Greensboro, N.C.

CoreLogic: 2Q Mortgage Fraud Risk Drops by 7.5% Year Over Year

CoreLogic, Irvine, Calif., reported a 7.5 percent year over year decrease in fraud risk in as of the end of the second quarter.

MBA: 2Q Commercial/Multifamily Mortgage Delinquency Rates Decline

Commercial and multifamily mortgage delinquencies declined in the second quarter, the Mortgage Bankers Association’s latest Commercial/Multifamily Delinquency Report said.

#MBARMQA22: ‘Holding the Line to Protect Your Companies’

NASHVILLE, TENN.—Mortgage Bankers Association President & CEO Bob Broeksmit, CMB, said sound risk management practices make the difference in an evolving mortgage market.

Home Building Increases in Disaster-Prone Areas

More than half of homes built today face fire risk, compared to 14% of homes built from 1900 to 1959, as suburbanization and a shift to the Sun Belt push builders into more vulnerable areas, said Redfin, Seattle.

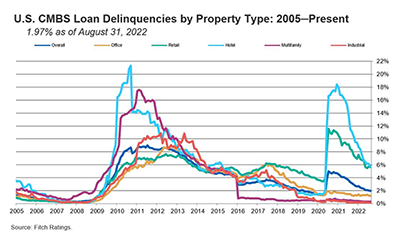

CMBS Loan Delinquency Rate Drops Below 2%

Fitch Ratings, New York, said the commercial mortgage-backed securities delinquency rate fell eight basis points in August to 1.97% due to continued strong resolutions and fewer new delinquencies.