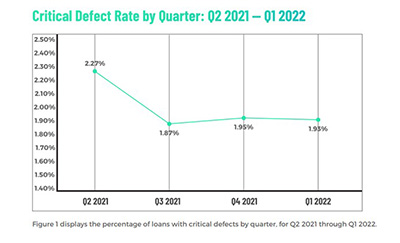

ACES Quality Management, Denver, said the overall critical defect rate declined for the second straight quarter despite a more challenging mortgage lending environment.

Category: News and Trends

MBA White Paper: Office Market ‘Likely Changed Forever’

The ongoing tug of war between employers and employees about returning to the office will accelerate as pandemic-related impacts fade, according to a new Mortgage Bankers Association white paper.

MBA Regulatory Compliance Conference in D.C. Sept. 18-20

The Mortgage Bankers Association’s annual Regulatory Compliance Conference takes place Sept. 18-20 at the Grand Hyatt in Washington, D.C.

Quote

“Everyone has a role in risk management. Revenue is not as important as having sound practices in place.”

—-Cheryl Feltgen, Executive Vice President and Chief Risk Officer with Arch Mortgage Insurance Co., Greensboro, N.C.

CoreLogic: 2Q Mortgage Fraud Risk Drops by 7.5% Year Over Year

CoreLogic, Irvine, Calif., reported a 7.5 percent year over year decrease in fraud risk in as of the end of the second quarter.

MBA: 2Q Commercial/Multifamily Mortgage Delinquency Rates Decline

Commercial and multifamily mortgage delinquencies declined in the second quarter, the Mortgage Bankers Association’s latest Commercial/Multifamily Delinquency Report said.

#MBARMQA22: ‘Holding the Line to Protect Your Companies’

NASHVILLE, TENN.—Mortgage Bankers Association President & CEO Bob Broeksmit, CMB, said sound risk management practices make the difference in an evolving mortgage market.

Home Building Increases in Disaster-Prone Areas

More than half of homes built today face fire risk, compared to 14% of homes built from 1900 to 1959, as suburbanization and a shift to the Sun Belt push builders into more vulnerable areas, said Redfin, Seattle.

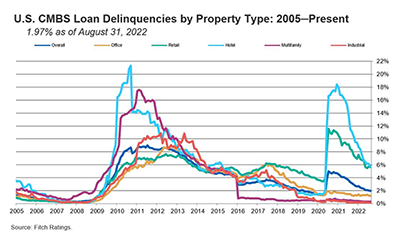

CMBS Loan Delinquency Rate Drops Below 2%

Fitch Ratings, New York, said the commercial mortgage-backed securities delinquency rate fell eight basis points in August to 1.97% due to continued strong resolutions and fewer new delinquencies.

MBA White Paper: Office Market ‘Likely Changed Forever’

The ongoing tug of war between employers and employees about returning to the office will accelerate as pandemic-related impacts fade, according to a new Mortgage Bankers Association white paper.