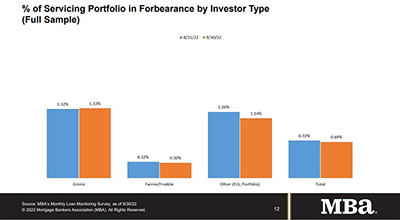

The Mortgage Bankers Association’s monthly Loan Monitoring Survey reported loans in forbearance decreased by 3 basis points to 0.69% of servicers’ portfolio volume as of Sept. 30, down from 0.72% in August. MBA estimates 345,000 homeowners remain in forbearance plans.

Category: News and Trends

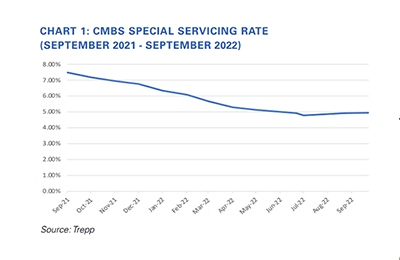

CMBS Delinquency Rate Falls; Special Servicing Rate Increases

The commercial mortgage-backed securities delinquency rate fell slightly in September, offset by an increase in the special servicing rate.

MBA Urges FHFA to Embrace Standards-Based Technology Approaches to Fintech

The Mortgage Bankers Association, in a letter last week to the Federal Housing Finance Agency, said the Agency should not inadvertently hinder innovation through choices made by its regulated entities.

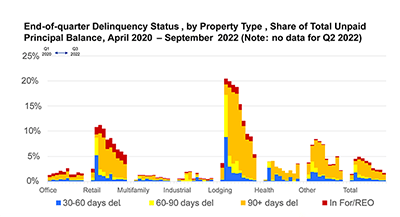

MBA: 3Q Commercial, Multifamily Mortgage Delinquency Rates Decline

Delinquency rates for mortgages backed by commercial and multifamily properties declined through the third quarter, according to the Mortgage Bankers Association’s latest CREF Loan Performance Survey.

MBA, Black Homeownership Collaborative Urge HUD to Reduce FHA Mortgage Insurance Premiums

The Mortgage Bankers Association and several trade associations representing the Black Homeownership Collaborative sent a letter to HUD Secretary Marcia Fudge last week urging the Department to make meaningful reductions to the annual Mortgage Insurance Premium and suspend life-of-loan requirements for borrowers with FHA-insured loans.

MBA Commends FHFA’s New Enterprise Housing Goals Methodology Proposal

The Mortgage Bankers Association on Thursday commended the Federal Housing Finance Agency for its proposed rule establishing 2023-2024 Multifamily Enterprise Housing Goals for Fannie Mae and Freddie Mac.

MISMO Seeks Public Comment on FIPS Code Lending Limit API Specification

MISMO®, the real estate finance industry standards organization, seeks public comment on a new FIPS Code Lending Limit API Specification, which will illustrate how to define a standard REST-based OpenAPI for searching lending limits based on a property’s postal code and county name.

Foreclosure Activity Rises to Near Pre-Pandemic Levels

ATTOM, Irvine, Calif., reported September foreclosure activity rose by 3 percent in the third quarter and by 104 percent from a year ago.

Bob Caruso of ServiceMac on Changes in Mortgage Servicing and Subservicing

Bob Caruso is CEO of ServiceMac LLC, Fort Mill, S.C., a wholly owned subsidiary of First American Financial Corp. The company’s website is https://info.firstamericanmortgagesolutions.com/about-servicemac.

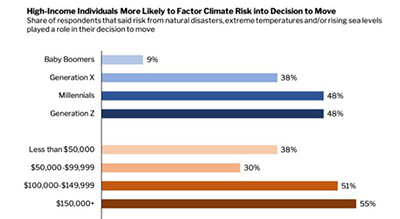

Homebuyers, Sellers Shift on Climate Risk Issues

Earlier this year, you could get a bidding war for swampland in Florida. Now, said Redfin, Seattle, homebuyers and sellers are getting pickier—and particularly when it comes to climate risk.