The Mortgage Bankers Associations Servicing Solutions Conference & Expo, Roadmap to Servicing Success, takes place Feb. 21-24 at the Hyatt Regency Orlando.

Category: News and Trends

#MBAAnnual22: Ginnie Mae, FHFA, FHA Go Big

NASHVILLE—Presentations by government agencies at major events such as the Mortgage Bankers Association’s Annual Convention & Expo can be pretty staid affairs. Not so this year. On Monday, Ginnie Mae, the Federal Housing Finance Agency and FHA made one major announcement after the other, literally creating their own news cycle.

MBA Forecast: Recession Likely in 2023, Mortgage Originations to Decline 9% to $2.05 Trillion

NASHVILLE—The Mortgage Bankers Association said total mortgage origination volume is expected to decline to $2.05 trillion in 2023 from the $2.26 trillion expected in 2022. Purchase originations are forecast to decrease by 3 percent to $1.53 trillion next year, while refinance volume is anticipated to decline by 24 percent to $513 billion.

Ginnie Mae Delays Issuers’ Risk-Based Capital Requirement to Dec. 2024

Ginnie Mae on Friday said it would extend its mandatory implementation date of its risk-based capital requirement by one additional year, to Dec. 31, 2024.

MISMO Seeks Public Comment on New Flood Risk Disclosure Resource Guide

MISMO®, the real estate finance industry standards organization, seeks public comment on a new Flood Risk Disclosure Resource Guide. The guide is designed to help homeowners and industry participants understand potential flood risks by listing publicly available resources, factors, and information that may be useful.

MBA Announces the Affordable Housing Alliance of Central Ohio as Local Host of CONVERGENCE Columbus

The Mortgage Bankers Association announced the Affordable Housing Alliance of Central Ohio will serve as the local host organization for CONVERGENCE Columbus, MBA’s initiative to help close the Black homeownership gap and promote affordable housing through community partnerships in Columbus, Ohio.

MISMO Seeks Public Comment on FIPS Code Lending Limit API Specification

MISMO®, the real estate finance industry standards organization, seeks public comment on a new FIPS Code Lending Limit API Specification, which will illustrate how to define a standard REST-based OpenAPI for searching lending limits based on a property’s postal code and county name.

MBA Servicing Solutions Conference & Expo in Orlando Feb. 21-24

The Mortgage Bankers Associations Servicing Solutions Conference & Expo, Roadmap to Servicing Success, takes place Feb. 21-24 at the Hyatt Regency Orlando.

Quote

“Next year will be particularly challenging for the U.S. and global economies. The sharp increase in interest rates this year – a consequence of the Federal Reserve’s efforts to slow inflation, will lead to an equally sharp slowdown in the economy, matching the downturn that is happening right now in the housing market.”

–MBA Chief Economist Mike Fratantoni.

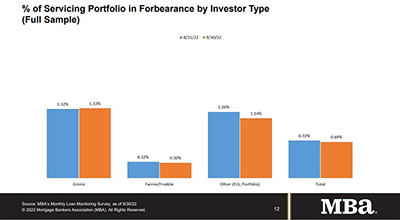

MBA: September Share of Mortgage Loans in Forbearance Decreases to 0.69%

The Mortgage Bankers Association’s monthly Loan Monitoring Survey reported loans in forbearance decreased by 3 basis points to 0.69% of servicers’ portfolio volume as of Sept. 30, down from 0.72% in August. MBA estimates 345,000 homeowners remain in forbearance plans.