The Leading Indicator of Remodeling Activity, a quarterly forecast from the Remodeling Futures Program at the Joint Center for Housing Studies of Harvard University, Cambridge, Mass., projects year-over-year growth in homeowner remodeling and repair spending to shrink from 16.1 percent in 2022 to 6.5 percent by the third quarter 2023.

Category: News and Trends

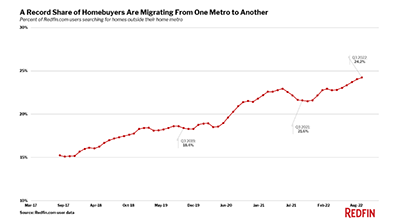

Record-High Number of Homebuyers Ready to Move Elsewhere

Redfin, Seattle, said rising mortgage rates and persistently high home prices are motivating many buyers who remain in the market to relocate to more affordable areas.

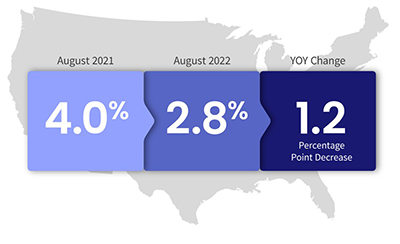

CoreLogic: Serious Mortgage Delinquency Rate Returns to Pre-Pandemic Low

CoreLogic, Irvine, Calif., said 2.8% of all mortgages in the U.S. were in some stage of delinquency (30 days or more past due, including those in foreclosure), a 1.2 percentage point decrease from 4% a year ago.

‘Zombie’ Foreclosures Up; Remain Small Portion of Housing Market

ATTOM, Irvine, Calif., reported 1.3 million residential properties in the United States sit vacant, representing 1.26 percent, or one in 79 homes, across the nation.

CFPB Issues Personal Financial Data Rights Rulemaking

The Consumer Financial Protection Bureau on Thursday outlined options it said are designed to strengthen consumers’ access to, and control over, their financial data.

Quote

“Housing and remodeling markets are undoubtedly slowing from the exceptionally high and unsustainable growth rates that followed in the wake of the pandemic-induced recession. Spending for home improvements will continue to face headwinds from declining home sales, rising interest rates, and the increasing costs of contractor labor and building materials.”

–Carlos Martín, Project Director of the Remodeling Futures Program at the Joint Center for Housing Studies at Harvard University.

MBA Servicing Solutions Conference & Expo in Orlando Feb. 21-24

The Mortgage Bankers Associations Servicing Solutions Conference & Expo, Roadmap to Servicing Success, takes place Feb. 21-24 at the Hyatt Regency Orlando.

#MBAAnnual22: Ginnie Mae, FHFA, FHA Go Big

NASHVILLE—Presentations by government agencies at major events such as the Mortgage Bankers Association’s Annual Convention & Expo can be pretty staid affairs. Not so this year. On Monday, Ginnie Mae, the Federal Housing Finance Agency and FHA made one major announcement after the other, literally creating their own news cycle.

MBA Forecast: Recession Likely in 2023, Mortgage Originations to Decline 9% to $2.05 Trillion

NASHVILLE—The Mortgage Bankers Association said total mortgage origination volume is expected to decline to $2.05 trillion in 2023 from the $2.26 trillion expected in 2022. Purchase originations are forecast to decrease by 3 percent to $1.53 trillion next year, while refinance volume is anticipated to decline by 24 percent to $513 billion.

Ginnie Mae Delays Issuers’ Risk-Based Capital Requirement to Dec. 2024

Ginnie Mae on Friday said it would extend its mandatory implementation date of its risk-based capital requirement by one additional year, to Dec. 31, 2024.