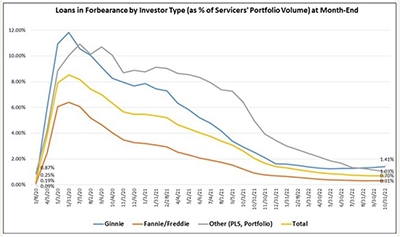

The Mortgage Bankers Association’s monthly Loan Monitoring Survey reported loans in forbearance increased by 1 basis point to 0.70% of servicers’ portfolio volume from 0.69% in the prior month as of October 31.

Category: News and Trends

MBA Report: IMBs Report 3Q Losses

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net loss of $624 on each loan originated in the third quarter, the Mortgage Bankers Association reported Friday.

FHA 2022 Actuarial Report Shows Continued Improvements in Capital Ratio, HECM Performance

The Federal Housing Administration on Nov. 15 released its Annual Actual Report on the status of its Mutual Mortgage Insurance Fund, showing an increase in congressionally mandated capital reserve ratios, lower delinquency levels and a decrease in borrowers in forbearance plans.

MBA Education Workshop Feb. 13: Fundamentals of Mortgage Banking for Servicing Professionals

MBA Education presents a one-day Workshop, Fundamentals of Mortgage Banking for Servicing Professionals, on Monday, Feb. 13 from 10:00 a.m.-3:30 p.m. ET.

MBA Servicing Solutions Conference & Expo in Orlando Feb. 21-24

The Mortgage Bankers Associations Servicing Solutions Conference & Expo, Roadmap to Servicing Success, takes place Feb. 21-24 at the Hyatt Regency Orlando.

MBA Education Webinar Dec. 14: Ensuring HMDA Data Integrity and Common Reporting Issues

MBA Education holds a Webinar, Ensuring HMDA Data Integrity and Common Reporting Issues, on Wednesday, Dec. 14 from 2:00-3:00 p.m. ET.

Make Your Voice Heard through MBA Mortgage Action Alliance

The MBA Mortgage Action Alliance is a voluntary, non-partisan and free nationwide grassroots lobbying network of real estate finance industry professionals, affiliated with the Mortgage Bankers Association.

Quote

“Given FHA’s healthy financial position, MBA continues to believe that HUD should make FHA loans more affordable by reducing mortgage insurance premiums as soon as budgetary opportunities allow. This move would help offset the impact of higher mortgage rates and improve the purchasing power for many prospective first-time homebuyers, minority buyers, and those with low and moderate incomes.”

–MBA President & CEO Robert Broeksmit, CMB.

HUD Increase Flood Insurance Options for FHA Mortgage Holders in Special Flood Areas

HUD on Monday announced it will allow homeowners with FHA-insured mortgage financing to obtain flood insurance policies that conform to FHA requirements from private insurance providers.

MBA: October Share of Mortgage Loans In Forbearance Up Slightly

The Mortgage Bankers Association’s monthly Loan Monitoring Survey reported loans in forbearance increased by 1 basis point to 0.70% of servicers’ portfolio volume from 0.69% in the prior month as of October 31.