The MBA Mortgage Action Alliance is a voluntary, non-partisan and free nationwide grassroots lobbying network of real estate finance industry professionals, affiliated with the Mortgage Bankers Association.

Category: News and Trends

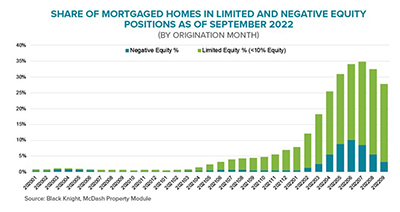

Black Knight: 8% of 2022 Mortgaged Home Purchases Underwater; FHA Loans See Early-Payment Defaults Rise

Black Knight, Jacksonville, Fla., said of all homes purchased with a mortgage in 2022, 8% are now at least marginally underwater and nearly 40% have less than 10% equity stakes in their home, a situation most concentrated among FHA/VA loans.

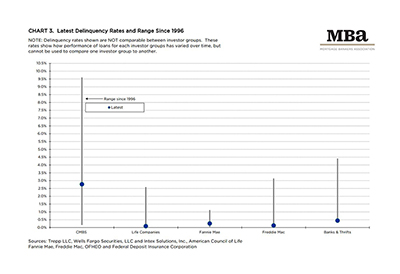

MBA: 3Q Commercial/Multifamily Mortgage Delinquencies Remain Low

Commercial and multifamily mortgage delinquencies showed little movement in the third quarter, according to the Mortgage Bankers Association’s latest Commercial/Multifamily Delinquency Report.

MBA Mortgage Action Alliance Call to Action Urges Support for Affordable Housing Legislation

The MBA Mortgage Action Alliance this week issued a Call to Action, urging its members to contact their members of Congress in support of bipartisan, bicameral legislation designed to improve, expand, and create tax credit programs that increase affordable housing supply for renters, homeowners and buyers.

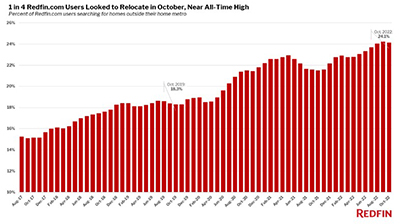

Redfin: Home Relocation Near Record High

The share of Redfin.com users looking to move to a different metro area is near its record high as high rates and prices up the appeal of affordable places.

Trepp: Life Insurance Returns on Pace for Worst Performance to Date

Trepp, New York, released its third quarter returns report for its life insurance commercial mortgage index, reporting the 2022 year-to-date return is predicted to be the lowest since Trepp started collecting LifeComps data in 1996.

Nearly Half of Rental Units in Properties with Four or Fewer Units

Nearly 46 percent of U.S. rental housing units are in properties with one to four units, the Rental Housing Finance Survey from HUD and the U.S. Census Bureau reported.

FHFA Raises 2023 GSE Conforming Loan Limits to $726,000

The Federal Housing Finance Agency on Tuesday increased the conforming loan limit values for mortgages to be acquired by Fannie Mae and Freddie Mac for one-unit properties to $726,200, an increase of 12.21 percent ($79,000) from $647,200 in 2022.

MBA Servicing Solutions Conference & Expo in Orlando Feb. 21-24

The Mortgage Bankers Associations Servicing Solutions Conference & Expo, Roadmap to Servicing Success, takes place Feb. 21-24 at the Hyatt Regency Orlando.

MBA Education Webinar Dec. 14: Ensuring HMDA Data Integrity and Common Reporting Issues

MBA Education holds a Webinar, Ensuring HMDA Data Integrity and Common Reporting Issues, on Wednesday, Dec. 14 from 2:00-3:00 p.m. ET.