The Mortgage Bankers Association, in a letter to the Federal Housing Finance Agency, offered a set of recommendations addressing the Agency’s efforts to improve home equity, particularly with respect to the racial homeownership gap.

Category: News and Trends

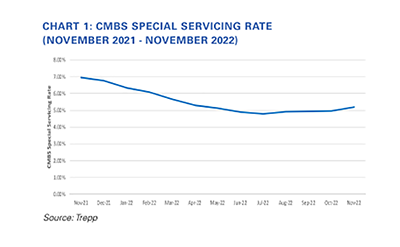

CMBS Special Servicing Rate Rises Again

Trepp, New York, reported the commercial mortgage-backed securities special servicing rate increased in November for the fourth consecutive month.

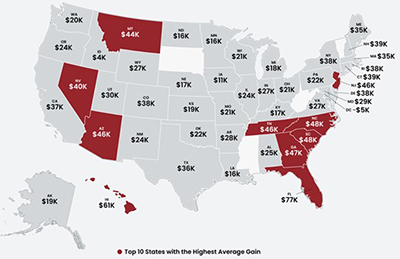

CoreLogic: Home Equity Gains Down Sharply From Second Quarter

CoreLogic, Irvine, Calif., reported homeowners posted average annual equity gains of $34,300 in the third quarter—half the year-over-year increase recorded in the second quarter.

Fitch: Heightened Risk of ‘Severe’ U.S. Housing Downturn in 2023

Fitch Ratings, New York, said it expects the housing market to weaken further in 2023 as affordability issues, softening economic environment and low consumer confidence continue to erode demand.

John Walsh of LERETA on Servicing Tax Issues

John Walsh is CEO of LERETA, Pomona, Calif. He leads an executive leadership team focused on providing the mortgage and insurance industries accuracy, responsiveness and innovative technology.

CFPB Provides Guidance on HMDA Loan Reporting Threshold

The Consumer Financial Protection Bureau said it does not intend to “initiate enforcement actions or cite Home Mortgage Disclosure Act violations for failures to report closed-end mortgage data collected in 2022, 2021 and 2020” for covered institutions that originated at least 25 closed-end loans, but less than 100 closed-end loans in each of the previous two calendar years.

ATTOM: Foreclosure Completions Up 64%

ATTOM, Irvine, Calif., reported 30,677 U.S. properties with foreclosure filings in October, up 57 percent from a year ago, but down 5 percent from October.

JLL: Caution Dampens Real Estate Investment

JLL, Chicago, reported third quarter real estate investment fell nearly 25% year-over-year global to $234 billion.

Fitch: U.S. Mortgage Insurers’ 2023 Performance Pressured by Inflation, Slowing Home Prices

Fitch Ratings, New York, said stronger headwinds brought on by a slowing U.S. economy and falling home prices will likely weigh on U.S. mortgage insurers next year.

MBA Education Workshop Feb. 13: Fundamentals of Mortgage Banking for Servicing Professionals

MBA Education presents a one-day Workshop, Fundamentals of Mortgage Banking for Servicing Professionals, on Monday, Feb. 13 from 10:00 a.m.-3:30 p.m. ET.