“There were pockets of weakness in the November data, despite the forbearance rate remaining unchanged and the overall loan performance of serviced loans staying mostly flat.”

–Marina Walsh, CMB, MBA Vice President of Industry Analysis.

“There were pockets of weakness in the November data, despite the forbearance rate remaining unchanged and the overall loan performance of serviced loans staying mostly flat.”

–Marina Walsh, CMB, MBA Vice President of Industry Analysis.

Commercial and multifamily mortgage debt outstanding increased by $70.0 billion (1.6 percent) in the third quarter, the Mortgage Bankers Association reported Tuesday in its quarterly Commercial/Multifamily Mortgage Debt Outstanding Report.

The Mortgage Bankers Associations Servicing Solutions Conference & Expo, Roadmap to Servicing Success, takes place Feb. 21-24 at the Hyatt Regency Orlando.

The MBA Mortgage Action Alliance is a voluntary, non-partisan and free nationwide grassroots lobbying network of real estate finance industry professionals, affiliated with the Mortgage Bankers Association.

MBA Education presents a one-day Workshop, Fundamentals of Mortgage Banking for Servicing Professionals, on Monday, Feb. 13 from 10:00 a.m.-3:30 p.m. ET.

Commercial and multifamily mortgage debt outstanding increased by $70.0 billion (1.6 percent) in the third quarter, the Mortgage Bankers Association reported Tuesday in its quarterly Commercial/Multifamily Mortgage Debt Outstanding Report.

The Mortgage Bankers Association, in a letter to the Federal Housing Finance Agency, offered a set of recommendations addressing the Agency’s efforts to improve home equity, particularly with respect to the racial homeownership gap.

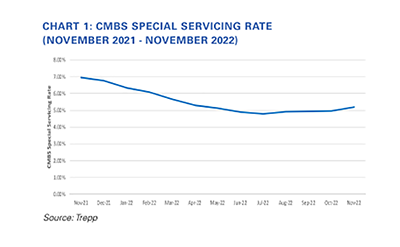

Trepp, New York, reported the commercial mortgage-backed securities special servicing rate increased in November for the fourth consecutive month.

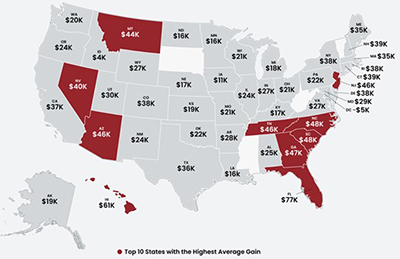

CoreLogic, Irvine, Calif., reported homeowners posted average annual equity gains of $34,300 in the third quarter—half the year-over-year increase recorded in the second quarter.

Fitch Ratings, New York, said it expects the housing market to weaken further in 2023 as affordability issues, softening economic environment and low consumer confidence continue to erode demand.