The Federal Housing Finance Agency published a final rule that requires Fannie Mae and Freddie Mac to provide advance notice to FHFA of new activities and obtain prior approval before launching new products.

Category: News and Trends

MBA: November Share of Mortgage Loans in Forbearance Flat

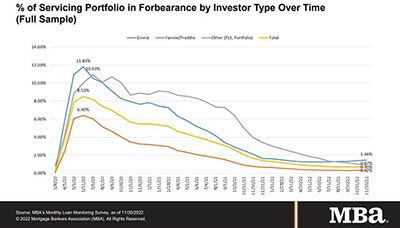

The Mortgage Bankers Association’s monthly Loan Monitoring Survey reported loans in forbearance remained flat at 0.70% as of November 30. MBA estimates 350,000 homeowners are in forbearance plans.

Quote

“It has always been our goal to support an orderly and successful transition from LIBOR in coordination with the Federal Housing Finance Agency, the Alternative Reference Rates Committee, and other mortgage market participants and we will continue to work toward that goal.”

–Bob Ives, Chief Investment Officer with Fannie Mae, Washington, D.C.

MBA Servicing Solutions Conference & Expo in Orlando Feb. 21-24

The Mortgage Bankers Associations Servicing Solutions Conference & Expo, Roadmap to Servicing Success, takes place Feb. 21-24 at the Hyatt Regency Orlando.

Make Your Voice Heard through MBA Mortgage Action Alliance

The MBA Mortgage Action Alliance is a voluntary, non-partisan and free nationwide grassroots lobbying network of real estate finance industry professionals, affiliated with the Mortgage Bankers Association.

MBA Education Workshop Feb. 13: Fundamentals of Mortgage Banking for Servicing Professionals

MBA Education presents a one-day Workshop, Fundamentals of Mortgage Banking for Servicing Professionals, on Monday, Feb. 13 from 10:00 a.m.-3:30 p.m. ET.

MBA Offices Closed Dec. 26-Jan. 2

This is the final issue of MBA Servicing NewsLink for 2022.

MBA: November Share of Mortgage Loans in Forbearance Flat

The Mortgage Bankers Association’s monthly Loan Monitoring Survey reported loans in forbearance remained flat at 0.70% as of November 30. MBA estimates 350,000 homeowners are in forbearance plans.

MBA, Trade Groups Urge FTC to Crack Down on Banking Scams

The Mortgage Bankers Association, the American Bankers Association and other banking trade associations urged the Federal Trade Commission to crack down on those who impersonate banks or government officials in scams.

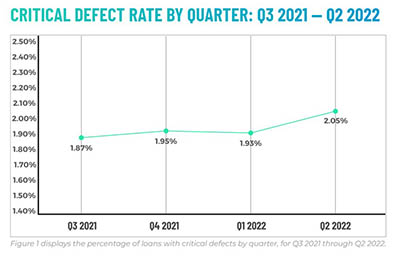

ACES: Critical Defect Rates Up 6%

ACES Quality Management, Denver, issued its quarterly Mortgage QC Industry Trends Report, showing the overall critical defect rate increased by 6% in the second quarter to 2.05%, crossing the 2% threshold for only the third time in this report’s history.