“For three consecutive months, the forbearance rate has remained flat–an indicator that we may have reached a floor on further improvements.”

–Marina Walsh, CMB, MBA Vice President of Industry Analysis.

“For three consecutive months, the forbearance rate has remained flat–an indicator that we may have reached a floor on further improvements.”

–Marina Walsh, CMB, MBA Vice President of Industry Analysis.

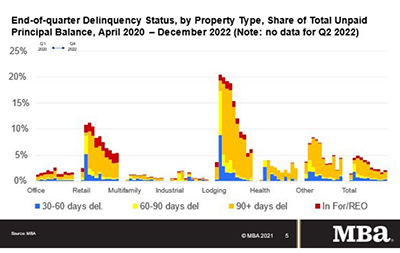

Delinquency rates for mortgages backed by commercial and multifamily properties increased slightly through the fourth quarter, the Mortgage Bankers Association’s latest CREF Loan Performance Survey reported.

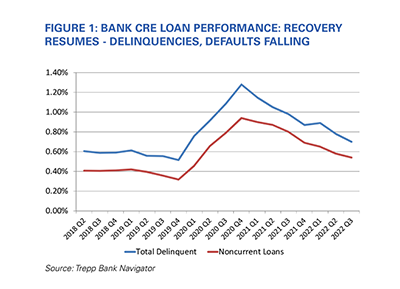

Trepp, New York, said delinquency rates for commercial real estate loans held by banks declined in third-quarter 2022 after increasing modestly earlier in the year.

The Consumer Financial Protection Bureau on Wednesday issued a proposed rule to establish a public registry of supervised nonbanks’ terms and conditions in “take it or leave it” form contracts that claim to waive or limit consumer rights and protections, such as bankruptcy rights, liability amounts or complaint rights.

ATTOM, Irvine, Calif., said 2022 foreclosure filings more than doubled from 2021 but remained well below pre-pandemic rates.

Servicing retention generates servicing fee income and helps servicers improve the customer experience. Modern loan servicing software automates investor reporting and compliance and creates a more efficient workflow, allowing servicers to effectively service loans in-house.

“Commercial and multifamily mortgages continued to perform well through the fourth quarter of 2022, albeit with a slight increase in the share of loans that are delinquent. Delinquency rates increased by small amounts for most property types even while the overall rate of delinquency remains low.”

–Jamie Woodwell, MBA Head of Commercial Real Estate Research.

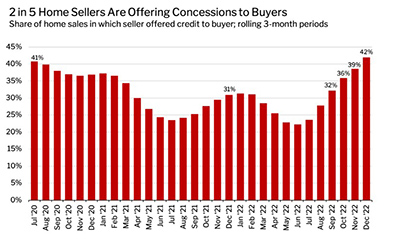

The housing market’s about-face from a sellers’ market to a buyers’ market played out in stark fashion in the fourth quarter, with a record share of home buyers asking for—and receiving concessions in home sales, said Redfin, Seattle.

Zillow Home Loans, Seattle, said recently announced new conforming limits for loans eligible to be sold to Fannie Mae and Freddie Mac mean nearly two million U.S. homes no longer require jumbo loans.

The Federal Housing Finance Agency on Wednesday released the 2023 Scorecard for Fannie Mae and Freddie Mac and their joint venture, Common Securitization Solutions LLC.