Reports from CoreLogic, Irvine, Calif., and Black Knight, Jacksonville, Fla., as well as last Monday’s Loan Monitoring Report from the Mortgage Bankers Association, show mortgage performance in the post-pandemic era remains strong and healthy.

Category: News and Trends

Quote (Jan. 31)

“By the end of 2024-2025, half of the mortgages will be part of the ‘new normal,’ and what I expect to see is a huge run-up in property values in the future. We have to be able to see around the corner so that we can manage change and not be managed by change.”

–Stanley Middleman, CEO of Freedom Mortgage Corp., Mount Laurel, N.J.

Call for Speakers: MBA Secondary & Capital Markets Conference & Expo; Deadline Feb. 2

Speaking opportunities for breakout sessions are now being accepted for MBA’s Secondary & Capital Markets Conference & Expo 2023, taking place May 21–24 at the Marriott Marquis in Times Square.

Share of Mortgage Loans in Forbearance Remains Flat at 0.70% in December

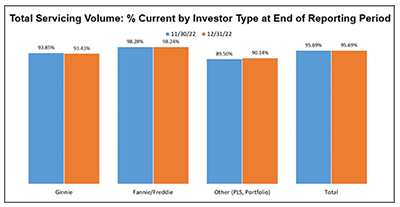

The Mortgage Bankers Association’s monthly Loan Monitoring Survey revealed the total number of loans now in forbearance remained flat relative to the prior month at 0.70% as of December 31, 2022.

FHFA Increases Fannie Mae, Freddie Mac Multifamily Radon Standards

The Federal Housing Finance Agency announced enhancements to Fannie Mae and Freddie Mac’s multifamily radon standards. The Mortgage Bankers Association commended the announcement.

Call for Speakers: MBA Secondary & Capital Markets Conference & Expo; Deadline Feb. 2

Speaking opportunities for breakout sessions are now being accepted for MBA’s Secondary & Capital Markets Conference & Expo 2023, taking place May 21–24 at the Marriott Marquis in Times Square.

GSEs Reduce Upfront Fee for Commingled Securities; FHFA Updates GSEs’ Single-Family Pricing Framework

Fannie Mae and Freddie Mac announced a reduction in the upfront fee for commingled securities to 9.375 basis points, effective April 1; additionally, the Federal Housing Finance Agency announced updates to the government-sponsored enterprises’ single-family pricing framework, effective May 1.

FHFA Increases Fannie Mae, Freddie Mac Multifamily Radon Standards

The Federal Housing Finance Agency announced enhancements to Fannie Mae and Freddie Mac’s multifamily radon standards. The Mortgage Bankers Association commended the announcement.

Higher Rates Make Renting More Affordable that Homeownership

ATTOM, Irvine, Calif., said higher mortgage interest rates tipped the needle toward renting over homeownership.

MBA Servicing Solutions Conference and Expo in Orlando Feb. 21-24

The Mortgage Bankers Associations Servicing Solutions Conference & Expo, Roadmap to Servicing Success, takes place Feb. 21-24 at the Hyatt Regency Orlando.