The MBA Mortgage Action Alliance is a voluntary, non-partisan and free nationwide grassroots lobbying network of real estate finance industry professionals, affiliated with the Mortgage Bankers Association.

Category: News and Trends

MBA Education Workshop Feb. 13: Fundamentals of Mortgage Banking for Servicing Professionals

MBA Education presents a one-day Workshop, Fundamentals of Mortgage Banking for Servicing Professionals, on Monday, Feb. 13 from 10:00 a.m.-3:30 p.m. ET.

Fannie Mae, Freddie Mac Announce Replacement Rates for Legacy LIBOR Products

Fannie Mae and Freddie Mac on Dec. 22 announced replacement rates for legacy LIBOR loans and securities.

ATTOM: Home Affordability Worsens in 4Q Despite Falling Home Prices

ATTOM, Irvine, Calif., released its fourth-quarter U.S. Home Affordability Report showing median-priced single-family homes and condos are less affordable compared to historical averages in 99 percent of counties across the nation — far above the 68 percent of counties that were less affordable a year ago.

CMBS Supply-Demand Fundamentals Slip

Commercial property market supply and demand fundamentals slipped in the third quarter, reported Moody’s Investors Service, New York.

FHFA Announces Final Rule for New GSE Products, Activities

The Federal Housing Finance Agency published a final rule that requires Fannie Mae and Freddie Mac to provide advance notice to FHFA of new activities and obtain prior approval before launching new products.

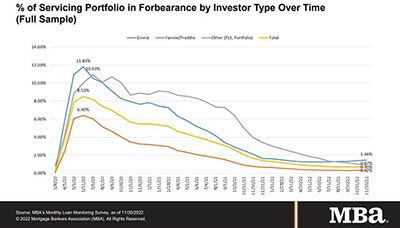

MBA: November Share of Mortgage Loans in Forbearance Flat

The Mortgage Bankers Association’s monthly Loan Monitoring Survey reported loans in forbearance remained flat at 0.70% as of November 30. MBA estimates 350,000 homeowners are in forbearance plans.

Quote

“It has always been our goal to support an orderly and successful transition from LIBOR in coordination with the Federal Housing Finance Agency, the Alternative Reference Rates Committee, and other mortgage market participants and we will continue to work toward that goal.”

–Bob Ives, Chief Investment Officer with Fannie Mae, Washington, D.C.

MBA Servicing Solutions Conference & Expo in Orlando Feb. 21-24

The Mortgage Bankers Associations Servicing Solutions Conference & Expo, Roadmap to Servicing Success, takes place Feb. 21-24 at the Hyatt Regency Orlando.

Make Your Voice Heard through MBA Mortgage Action Alliance

The MBA Mortgage Action Alliance is a voluntary, non-partisan and free nationwide grassroots lobbying network of real estate finance industry professionals, affiliated with the Mortgage Bankers Association.